-

Employers tried new strategies to tame benefit expenses, such as self-funding and association health plans.

December 20 -

The expansion aims to make it easier for workers to spend HSA and FSA dollars, and name their prices on services like MRIs.

November 29 -

Retirement readiness would vastly improve by requiring auto features, increasing HSA contribution limits, and outlawing participant loans, among other recommendations, says adviser Robert Lawton.

November 17 -

The tax plan would make itemized deductions less valuable so some retirees would lose a deduction that covers payments for nursing homes, assisted living or inpatient hospital care.

November 9 -

Under the rules, seniors face a tax liability for HSA contributions if they carry health coverage other than the high-deductible policy.

November 8 -

In response to Alexander-Murray compromise, administration reportedly looking to expand HSAs and association insurance programs.

October 26 -

In response to Alexander-Murray compromise, administration reportedly looking to expand HSAs and association insurance programs.

October 26 -

If a family contributes approximately $6,000 per year to an HSA, compounded at 6% growth for 20 years, that's $234,000 at retirement, says expert.

October 18 -

If a family contributes approximately $6,000 per year to an HSA, compounded at 6% growth for 20 years, that's $234,000 at retirement, says expert.

October 18 -

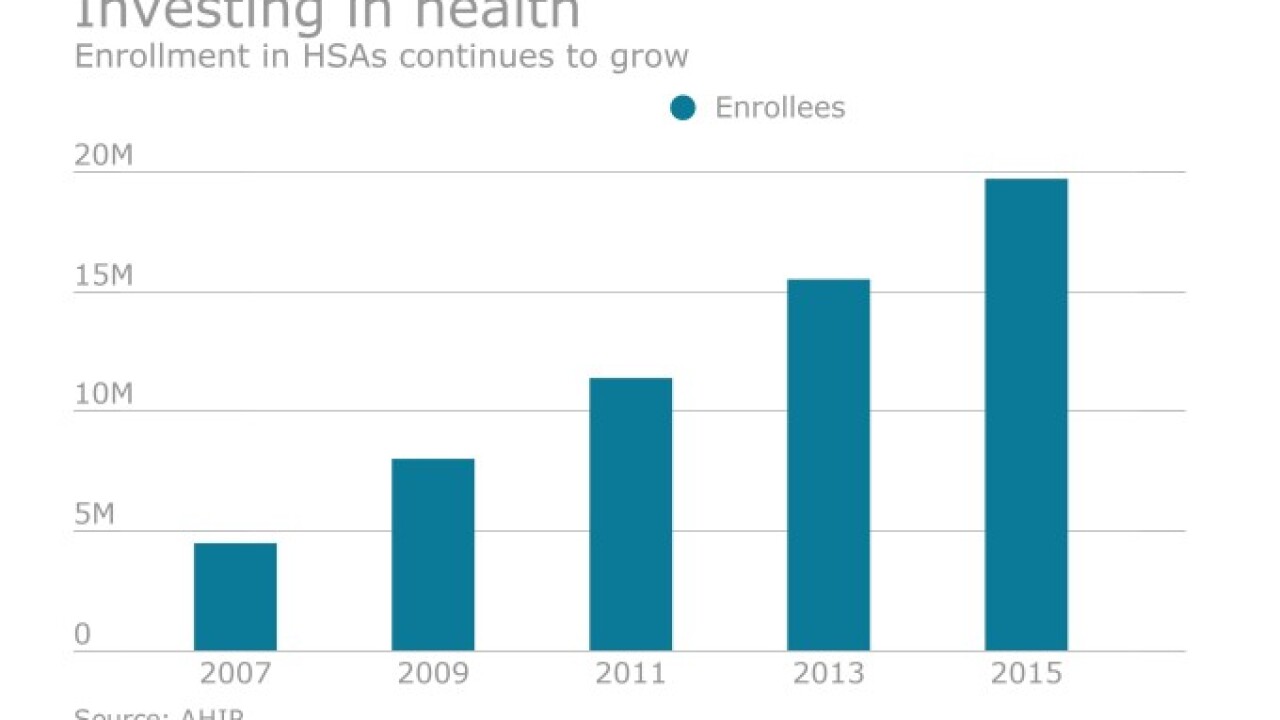

Instead of offsetting current healthcare costs, HSA providers are seeing workers prepare for their post-work medical expenses.

October 10