-

Sure, offering the perk will help employers recruit and retain top talent. But there’s even more advantages to consider.

September 28 -

Someone who starts saving from age 20 can sock away 90% less per month than someone who gets a later start at age 50 and still build the the same size of portfolio.

September 28 -

Employers with “great” retirement plans are significantly more likely to have higher margins and revenue per employee than those with average plans.

September 28 -

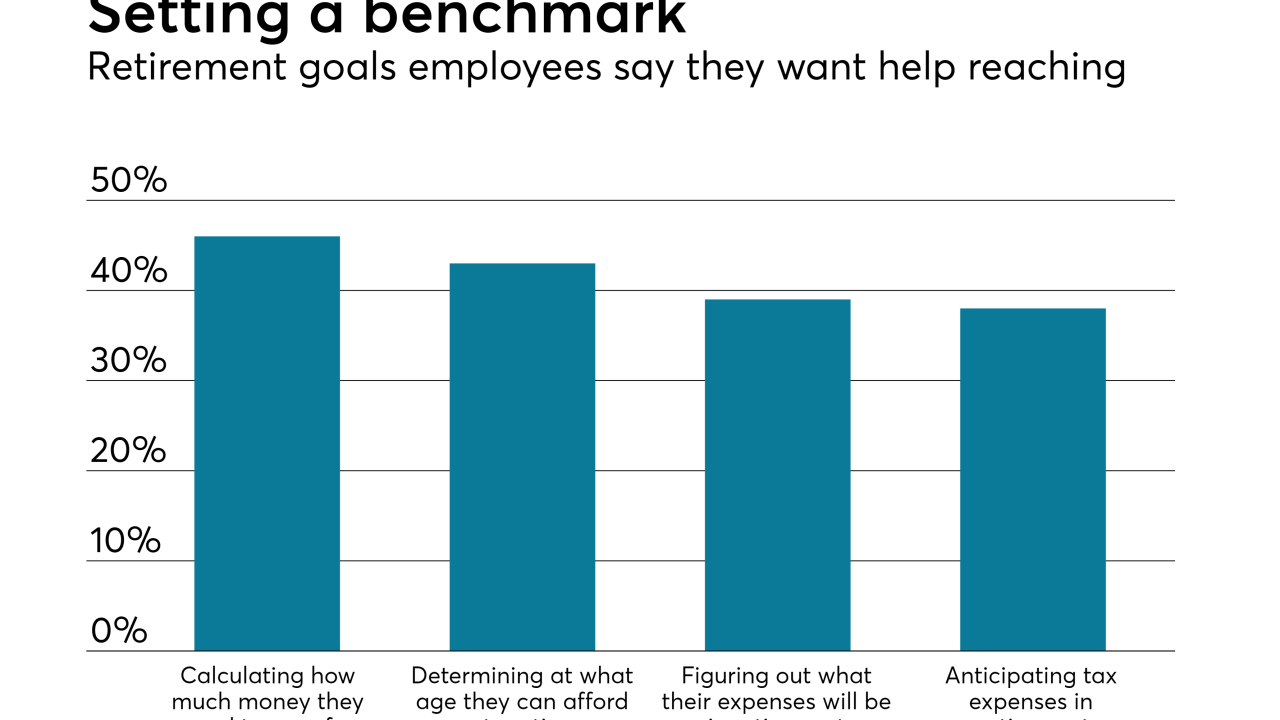

Employers must hit the throttle by providing employees with personalized retirement readiness scores, deeper metrics.

September 28 -

With low unemployment and companies sitting on large cash reserves, their employees still struggle to pay their bills.

September 28 -

Investors have an average of 25 funds to choose from in their 401(k) plans, but some financial advisors suggest that the best approach is to pick a small number of very broad funds.

September 27 -

Employers must hit the throttle by providing employees with personalized retirement readiness scores, deeper metrics.

September 27 -

Other groups, such as those who used to itemize tax deductions but will now use the high standard deduction, are also advised to check their withholding taxes.

September 26 -

Keep the initiatives confidential and offer incentives, said SunTrust’s financial well-being executive.

September 25 -

High-net-worth clients can bump into income limits when it comes to making Roth IRA contributions, but they can find other tax-saving strategies to save for retirement.

September 24