The annual limit on deductible contributions to a health savings account will jump by $50 in calendar year 2018 for individuals and $150 for families, according to the IRS.

For 2018, the annual contribution limitation for a person with self-only coverage under a high-deductible health plan is $3,450, up from $3,400 in calendar year 2017, the IRS announced last week. The annual limit on deductible contributions for a person with family coverage under a high-deductible health plan will be $6,900 in 2018, up from $6,750 in 2017.

Also, for 2018, the IRS defines a high-deductible health plan as a health plan with an annual deductible that is not less than $1,350 for self-only coverage — up $50 from 2017 — and $2,700 for family coverage, up $100 from 2017.

Annual out-of-pocket expenses have also increased from 2017: Deductibles, copayments and other amounts that do not include premiums will have a maximum limit of $6,650 for individual coverage and $13,300 for family coverage.

The increases are detailed in

See also:

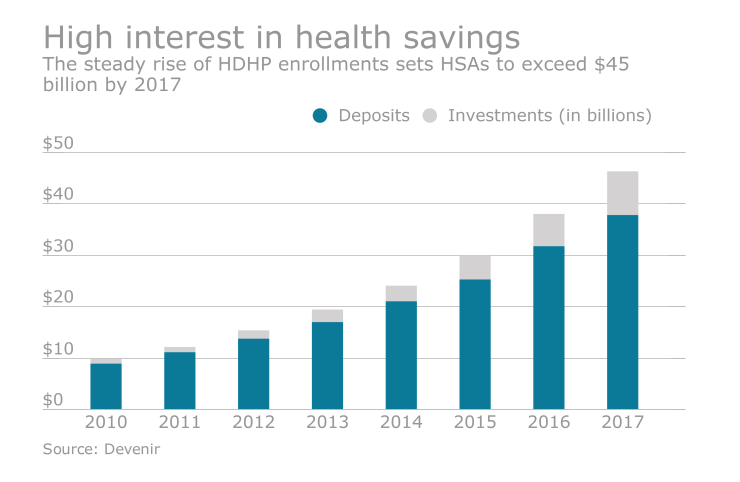

The health savings account market might change significantly in the near future as health reform efforts put them in the spotlight.

“HSA limit increases are currently tied to inflation, but with HSAs slated to play a pivotal role in health care reform, contribution limits may soon be uncoupled from traditional inflation increases and will give Americans much greater capacity for care-related tax savings,” notes Harrison Stone, general counsel at ConnectYourCare, a health savings account provider.

The