- Key insight: Discover how cash-pay options and biosimilars can circumvent opaque PBM pricing models.

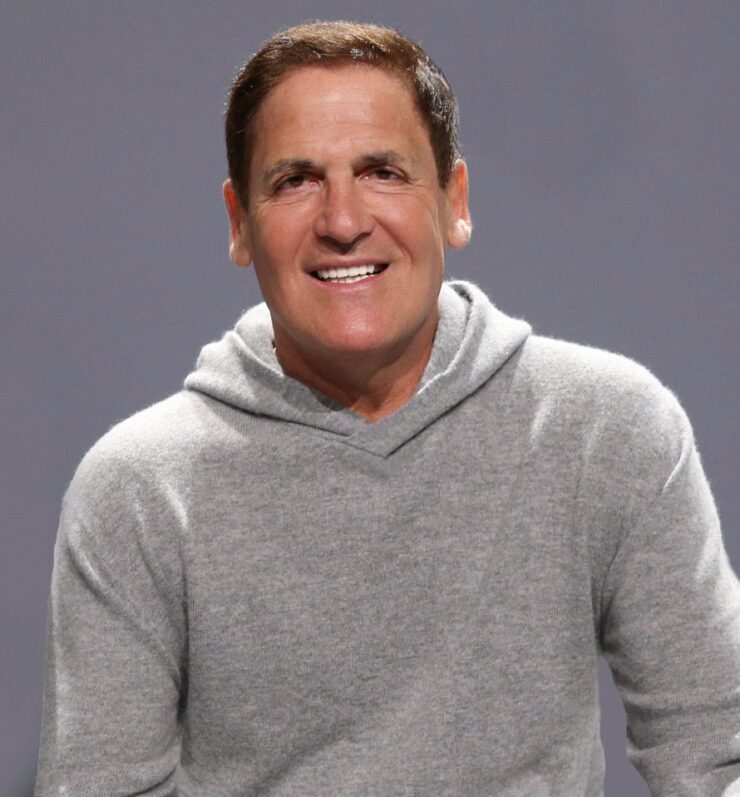

- Quote: Mark Cuban says self-insured plans "get to write" contract terms to require cash purchases.

- Forward look: Price-transparency tools (e.g., TrumpRx) will disrupt benefit design and deductible exposure.

- Source: Bullets generated by AI with editorial review

At a time when several highly-publicized class-action lawsuits have accused employers of

The biggest challenge in many companies is educating the C-suite about alternatives to reign in

Read more:

Self-insured employers, whether they're public or private, also can always require as part of their contract that any cash purchases apply to annual deductibles, he added in a spirited fireside chat with Scripta Insights CEO Eric Levin. "If you're self-insured, it's your contract. You get to write it the way you want," he said.

Another opportunity for substantial savings involves biosimilars, which are chemical copies of biologic drugs that have more complex proteins made from living cells. Cuban described them as the lowest-hanging fruit for Rx cost savings.

"We just came out with Starjemza, which is a biosimilar for Stelara, whose brand is $125,000 a year. Ours is $1,240 a year," said Cuban, co-founder of Cost Plus Drugs.

Cash carveouts are valuable because even the in-network prices charged are far higher than they should be, he observed. However, he lamented that too many benefit consultants don't suggest this option because they stand to gain from revenue-sharing agreements with huge health insurers and PBMs.

Read more:

Cuban recommends to every CEO he meets that they run their pharmacy benefit manager (PBM) contracts through ChatGPT, Gemini or another AI chatbot and ask if they're overpaying. "The big PBMs know that opacity pays their bills — the minute they got you to use coinsurance for specialty tiers, they knew they were ripping you off."

He urged the Big Three PBMs to compete with full transparency. "If you're so good at negotiating prices and you've got all this scale, then just show me your prices," he suggested. "Show me your rebates. Why do you need a rebate GPO [group purchasing organization] to negotiate and act as an intermediary so we can retain some of those rebates instead of just negotiating directly?"

He rhetorically questioned why a multi-$100 billion company would need to create a subsidiary, noting that's how PBMs in vertically-integrated conglomerates work around the system. "Big PBMs will come out and say, 'we're here to negotiate better pricing.' That's the biggest lie in all of pharmacy because they don't negotiate prices on brands," he said. "They auction off their formularies."

Auditing claims to hold PBMs more accountable represents another way to save money on prescription drug costs. Of all the companies Cuban has talked to that have audited their claims, he said "none of them have been overpaid in rebates, and every single one of them has been underpaid in rebates or overcharged in fees." And when these companies mention this to their PBMs, he said they immediately get higher rebates for fear of taking their business elsewhere.

Read more:

He suggested that employers, particularly those that are self-insured, simplify their pharmacy benefits instead of establishing tiers and therapeutics by class. "Trying to charge more for a pill that should cost nothing, that's just gaming the system," he said.

Levin also asked Cuban to weigh in on TrumpRx, which allows Americans to shop directly for prescription drugs at discounted rates without insurance. Noting that his company has thousands of drugs and Trump Rx presumably will have even more, Cuban believes this price transparency tool that will launch in 2026 will create some confusion. He cited as an example when beneficiaries discover that they're paying more in their deductible phase from the plan they're enrolled in when they can just look it up on TrumpRx or CostPlusDrugs.com.

"Whether it's Lily, Novo, Pfizer, Elegant, whoever it is, they want their best prices to be posted on Trump Rx," he says. "We have an API [active pharmaceutical ingredient] that has our entire price list. It's updated every day. We'll give that to them, and they get to post all of our prices. They won't actually fulfill or process anything. They'll send that back to whoever Lily or Pfizer is using, or to us to process it."

Irrespective of whatever impact TrumpRx has, Cuban noted that "this is an easy industry. What the doctors do, that's the hard part, and by the way, doctors should get paid a lot more. We want them to be able to take Wednesdays off and go golfing. I don't want them being stressed about having to have 10 surgeries every day."