Happy employees breed happy customers. According to Gallup, organizations that excel in engaging their employees achieve earnings-per-share growth that is more than four times that of their competitors.

So it’s disheartening to see our employees struggling for a lot of reasons, starting with the fear and anxiety they are feeling over the ongoing health crisis and what it’s doing to our financial markets. Most people’s work lives are still in disarray. Most haven’t returned to the office and have no timeline for when they may. Those that have are facing a new normal that includes regular COVID-19 testing and wearing PPE masks throughout the day.

Read more:

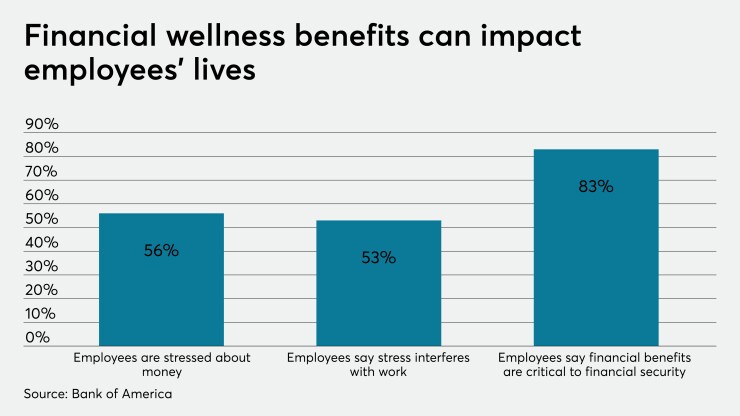

There has always been a strong connection between stress and healthcare costs, but financial stress has emerged as the number one form of stress for your employees. Today,

The impact of financial stress on healthcare

The strong connection between finances, stress, and healthcare costs supports the need for financial wellness benefits in the workplace.

The health of your employees is deteriorating because of financial stress. Of those who are financially stressed, they are 11 times more likely to have sleepless nights, 10 times more likely to not finish daily tasks at work, 9 times more likely to have troubled relationships with their coworkers, and 2 times more likely to be looking for a new job. Nearly three-quarters of employees experiencing financial stress also experience physical symptoms.

The rub — and how it really affects your business — is that people with financial stress tend to avoid getting healthcare, which leads to worse health outcomes and higher healthcare costs later on. More than half of employees with financial stress say that they avoid getting healthcare due to worries about how much it will cost.

A workforce with a greater number of financially stressed workers sees a greater number of sick days, higher healthcare costs, and increased absenteeism. Unscheduled absenteeism costs roughly $3,600 per year for each hourly worker and $2,650 each year for salaried employees.

Financial stress is costing you money, lessening efficiency, and having a deleterious impact on your customers. That’s a tough pill to swallow, but you have power over the situation. Your employees are looking to you to provide support and direction — and you can do that by implementing a financial wellness strategy.

What employers can do

Historically, employers have stayed clear of dealing with employees’ personal finances. And that has made sense — until recently. But, your employees are on overload: they are scared, confused, and struggling to make ends meet. At the same time, they are the backbone of your business and most responsible for your success. By offering financial wellness programs, employers can help improve the financial and physical health of employees.

Employees leveraging financial wellness programs saw their healthcare costs decrease by at least 4.5%; on the flip side, employees not using financial wellness programs saw a 19.4% increase in healthcare costs. That adds up: companies that have financial wellness programs in place are seeing a savings of

Case studies have demonstrated that companies can save money due to lower healthcare costs and reduced absenteeism when employees are able to participate in a financial wellness program.

How can employers prioritize financial wellness?

Perhaps one of the greatest changes lies in the evolving relationship between the employer and the employee. Globally 75% of people trust their employer to do ‘what is right’, significantly more than NGOs (57%), business (56%) and the media (47%). This means that an employer’s responsibility toward their people is set to change dramatically.

HR professionals are on the front line of this seismic change. They are also more pressed than ever, as demands from across their organizations have increased. There is often a feeling that there is hardly enough time to breathe, let alone think strategically about initiatives that will shift their organizations to greatness.

1. Know your workforce

2. Build a robust business case

3. Enable culture change

4. Focus on progress, not perfection

5. Communicate, communicate, communicate

6. Measure the impact

Your two most important assets are your customers and your employees and you have the power to help the latter continue to create indelible experiences for the former. Employers can start by helping those in most urgent need first. Employees experiencing financial stress are most concerned with paying down existing debt and there are free, easy to administer benefits available to kickstart your financial wellness program. Take control now and set your employees on a path to financial empowerment.