GumGum, a Santa Monica, California-based technology and artificial intelligence company, has expanded its employee benefits offering to include student loan repayment through the

Going into the open enrollment period, executives at GumGum knew they wanted to make some enhancements to the benefits offerings for 2020, says Kelly Battelle, vice president of people operations. The company has about 300 employees scattered across its global operations, and the majority of its U.S.-based workers are millennials or younger. Company CEO Phil Schraeder decided to implement the student loan benefit to attract and retain younger employees.

“Employees have a lot of choices today in terms of where they want to work in the media and technology industries,” Battelle says. “So any kind of additional thing employers can do to help them with the various stressors of life might be a decision-making factor for if they join the company.”

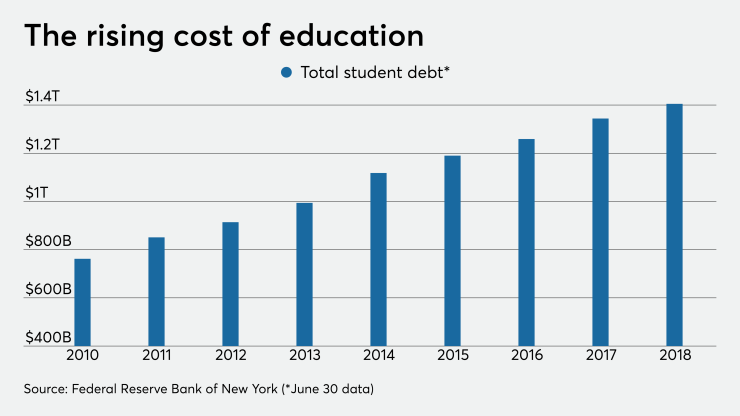

U.S. student loan debt hit $1.6 billion in 2019, according to the Federal Reserve. There are about 44 million Americans dealing with this financial burden, yet only 8% of employers offer a repayment benefit, according to the Society for Human Resource Management. Though that figure did double since 2018.

See Also:

The benefit took effect on the first of the year, and employees are eligible from the time they are hired. There are 41 GumGum employees using the Goodly benefit so far. The program is based on tenure, so an employee with zero to two years of experience will receive a contribution of $50 per month toward their loan from GumGum. Employees with two to four years at the company will receive $100 per month. Those with more than four years of employment with GumGum will get $200 per month on their loan. The contributions will continue until the loan is paid off.

Contributing to an employee’s student loan burden not only improves their overall wellness, it also creates a more loyal workforce.

“That’s one of the reasons we wanted to put in the tenure aspect,” Battelle says. “We’re incentivizing employees with different things to get them to stay longer at GumGum, in an industry where turnover is prevalent because there are so many choices.”

The Goodly platform also offers employees the chance to connect with financial advisers and request a contribution toward their loan from family or friends.

“With the help of employer contributions, the average GumGum employee is on track to pay off their student loans 27% faster than they otherwise would,” Goodly CEO Greg Poulin says. “This highlights how powerful student loan benefits are in reducing the financial stress student debt places on employees.”

GumGum has further expanded its benefits to include more support for working parents. GumGum began offering employees the Cleo platform, which helps employees navigate parenthood, from planning to start a family to expanding their existing family.

GumGum also increased its paid time off for birth parents to 16-18 weeks from 10 weeks, Battelle says. The employer now offers a one-month flexible transition back-to-work plan for new parents.

“We’re giving guidelines to managers and employees returning from their leave about how to offer some flexibility and ease back in to work,” she adds. “Now it’s a nice well-rounded set of parental offerings.”

GumGum has also upped its 401(k) match to 3.5% from 1.5% and included optional benefit offerings such as LegalShield, Travel Connect and a more robust EAP. The $50 the company offered toward a gym membership can now be used toward other wellness activities such as massage, acupuncture, or counseling.