As the population of people over the age of 65 continues to rise, more of today’s workforce is balancing the dual roles of employee and caregiver.

For some 44 million Americans, this burden affects an employee’s mental, financial and physical well-being. Employers have been taking more of an initiative in helping ease employees’ stressors by implementing specialized benefits.

However, mental and behavioral health strategies rank as the top clinical areas where two thirds of employers cut costs, according to Willis Towers Watson’s Best Practices in Healthcare Employer Survey.

To help employers manage healthcare costs and caregiving benefits, Willis Towers Watson health and benefits consulting practice leader Regina Ihrke, and managing director for retirement Alan Glickstein connected with Employee Benefit News.

Employers see health affordability as the most difficult challenge over the next 3 years. Why?

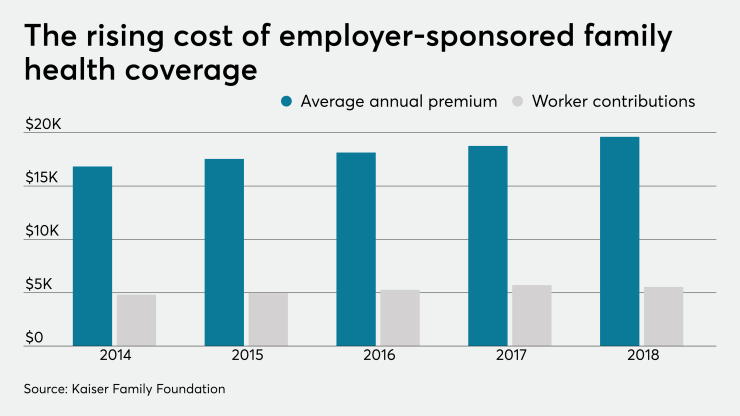

Ihrke: If you think about anything that’s increased for the last 20 years, healthcare services has risen faster than any other type of service and healthcare costs have risen significantly more than compensation. The piece of the pie that employees are taking home in their pay has shrunk because more of it is being taken out to pay for healthcare over time. So the affordability piece is two-fold. How do we continue to manage increases of healthcare costs that are between 5% to 10%, depending on the year, for each employer when employees’ total gross pay is only going up between 2% and 3% per year.

What can employers do to tackle this issue?

Ihrke: The first thing we would suggest is that there be a full analytics done on your employee population. Understand the state of their entire financial well-being. Learn what the population is doing to understand their financial stress. What are they doing about wage garnishment, loans, 401(k) disbursements, and how much are they putting into their 401(k)? Then look at the design of the health plan itself and look at where employees are as compared to benchmarks — what does the out of pocket cost look like for that employee from the premium piece, but also co-pays, deductibles and out of pocket maximums? Then you can layer in the supportive interventions that an employer can provide.

Glickstein: There is a need to look at this across dimensions, not just health costs, but the overall financial stress and thinking about putting the employee at the center. Think about that person and what they’re dealing with rather than programs that are targeted to very specific areas. When it comes down to it, a person is a person and you’ve got to look at it holistically.

How can employers reduce healthcare costs while also enhancing employees’ emotional well-being?

Ihrke: I’m not seeing much cutting healthcare costs so much as managing healthcare costs. Over the last several years I would say we’ve moved from a process of actually taking benefits away or covering less, to actually covering the pieces that are actually more important to those employees. We want to make sure we’re removing the barriers of care. We’re seeing more employers add pieces back in because it’s the right thing to do for those employees.

How does caregiving impact employers and employees?

Ihrke: I think the caregiving piece began in the last several years with paid leave on the maternity and paternity side. That seems to be the first initial aspect of caregiving, but now what’s being layered in is the other piece of caregiving. You really need to know what your population looks like and understand what their needs are. Getting their input is really key to understanding where the real pieces of the needs are. If you look at different employers and they are more swayed on the demographic population to baby boomers, then there’s a huge need for caregiving that’s not just for those on maternity leave. We see from our surveys that 57% of employers are looking to enhance the support of life event transitions over the next three years.

See Also:

Glickstein: Many of our clients have programs that are narrowly structured and not often heavily used. In the caregiving space a lot of it is just making sure the resources that are available are well-defined and they address the whole person in the interaction between emotional, physical, financial, social [parts] and acknowledge the pervasiveness of this in the workplace. I see first hand how the ongoing and unexpected demands of having to care for someone can put a lot of stress on people and the productivity of the workplace. There is a very strong financial interest and human support interest on the part of our clients in addressing that. All the clients we work with are putting that at the top of their list of things to focus on in 2020.

What will wellness benefits in 2020 look like?

Ihrke: Employers are looking at putting that person at the center. If an individual has an issue, they don’t wake up and say, ‘I want to work on a piece of my well-being for the day.’ There are four pillars of well-being: a physical side, a financial side, an emotional side and a social side. In any one instance of an individual’s issue there are adjacencies of all of those pillars that happen. The piece that we’re working with employers on is understanding and providing them the right program to connect those four pillars. It’s very different than the last decade of physical wellness, which was about metabolic syndrome, getting a biometric screening and paying for employees to have some incentive to get nutrition coaching. This is about taking care of wherever an individual is at their point of need and providing a variety of programs and solutions for the different needs of the population.

Glickstein: The focus is more on what’s really working or with what should we replace things that aren’t working well and how can we get the most out of the limited resources that are available to support employees. The focus in 2020 is going to be on really identifying the programs that can show a measurement of effectiveness in terms of targeting a particular need that the workforce has.