Montefiore St. Luke’s Cornwall Hospital has teamed up with Tuition.io to offer the organization’s 1,500 employees a new student loan repayment benefit.

As part of the Hudson Valley, New York-based hospital system’s new benefit, employees will be able to convert their unused paid time off into employer contributions toward paying down their debt. MSLC will offer all non-union workers the opportunity to convert 30 to 75 hours of unused PTO into a payment against student debt, which will be distributed semi-annually with a maximum of $5,000 in yearly contributions.

“The nice part of this benefit is that the employer has already accrued this expense for the PTO,” says Scott Thompson, CEO of Tuition.io. “This is not a new expense that they’re generating on behalf of employees for this benefit.”

The idea to offer this benefit developed organically, says Dan Bengyak, vice president of administrative services at MSLC. The hospital received feedback from employees who were frustrated they weren’t paid for leftover PTO they had earned. Employees rushing to use their time at the end of the year became disruptive to the hospital’s productivity, operations and patient care.

“We were just sitting around a whiteboard and asking how we could address these concerns in a meaningful way that also provides a benefit that’s really [valuable] to employees,” Bengyak says. “So we came up with the idea of doing the exchange of unused PTO.”

MSLC launched the program earlier this year and made the first payments toward student loans in June. There are more than 50 employee participants and the hospital has made a total contribution of about $90,000 toward those workers' student loans.

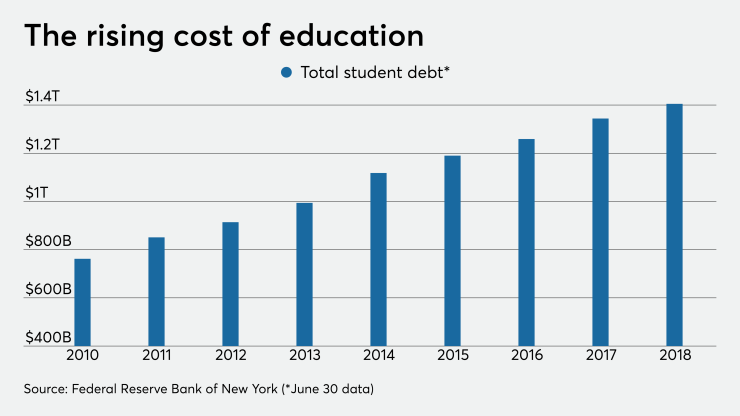

“As an employer we care about the wellness of our employees, which also includes their financial wellness,” Bengyak says. “We know that student loan debt is now one of the largest buckets of debt across the country.”

Indeed, the national student loan balance has ballooned to more than $1.5 trillion, according to the Federal Reserve. Nearly two-thirds of young adult job seekers have student loan debt with an average balance of $33,332, according to data from the American Institute of CPAs. More than three in four medical school students (76%) graduate with an average

“This is really a powerful tool for attracting and retaining talent,” Thompson says.

While it may seem that student debt is only a burden for younger generations in the workforce, older workers are also benefiting from MSLC’s new offering, Bengyak says.

“It’s been a really strong tool for some of our more advanced managerial candidates, because in healthcare there is life long learning and a lot of these folks have accrued student debt as they pursue master’s degrees or advanced practitioner status,” Bengyak says.

Employers are in a unique position to help employees get a better handle on this debt. But just 8% of U.S. employers offer their workers a student loan repayment benefit, compared with 4% in 2018, according to data from the Society for Human Resource Management. Some employers have been adding student repayment benefits such as

Thompson says he expects that number will grow. Considering the trajectory of adoption for other benefits, such as 401(k), he says that over time more employers will begin to adopt these benefits.

“I think what we’re seeing is the early stages of this acceleration,” he says.