Investors aren’t the only ones receiving financial guidance from Morgan Stanley. For employees with access to the investment bank’s financial wellness platform — part of Morgan Stanley at Work — a financial adviser is just a phone call away.

The bank has updated its existing financial wellness platform to include student loan refinancing, financial coaching and an upgraded digital portal. Employers who participate in Morgan Stanley’s retirement and stock plan benefits automatically have access to the new offerings.

“Our full suite of financial wellness offerings provide employees with access to resources covering a broad range of critical financial topics,” says Brian McDonald, head of Morgan Stanley at Work. “This type of education enables employees to build a holistic plan to help them make confident decisions to achieve their financial goals.”

McDonald says the company invested in its benefits platform because financial wellness is an in-demand employee benefit. The reason? Employees are stressed about money. Half of the employees in a survey of 1,000 say personal finances are their greatest stressors, according to a joint study by Morgan Stanley and the Financial Health Network — a Chicago-based nonprofit management company. Employees want professional help with their finances; 75% say they wish their employer provided financial wellness benefits, but only 30% of those workers feel their current benefits meet their needs.

“People generally stay with [employers] who satisfy their needs outside of work,” McDonald says. “We want to help firms solve their talent recruitment and retention needs, and reduce employee stress.”

McDonald says the new platform will help reduce some of that stress by making it easy for employees to access a financial adviser. Morgan Stanley contracted with My Secure Advantage — an independent financial coaching service — so employees can call a financial adviser directly whenever they have a question about personal finances. Advisers can assist employees with budgeting, debt management and credit problems.

“In order to offer a comprehensive financial wellness program, employers have to put the needs of participants first,” McDonald says. “Through the partnership with My Secure Advantage, we have the capability to solve problems at all levels of the organizations we serve, including those with financial challenges who aren’t ready to invest.”

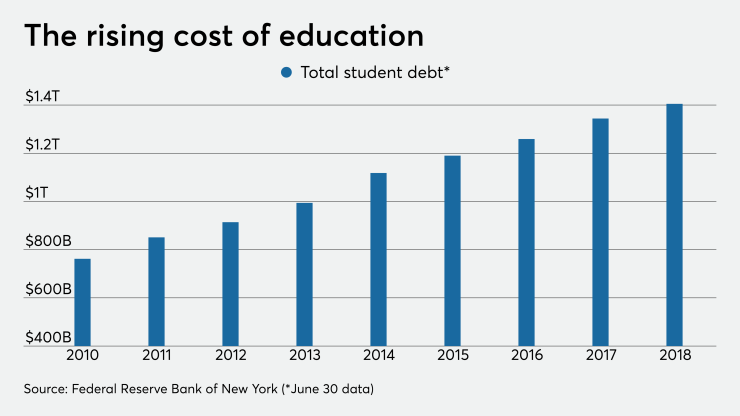

Employees may also be struggling to pay off debt. Collectively, Americans owe $1.5 trillion in student debt, a study by Pew Research Center finds. To help workers manage that debt, Morgan Stanley partnered with Credible, a digital lender marketplace, to provide student loan refinancing options through its platform. Student refinancing can make loan repayment more manageable by consolidating multiple loans into one monthly payment, McDonald says. Credible’s student loan refinancing marketplace is available on the Morgan Stanley platform, but users will also have access to a call center for a personalized experience.

“Through our research and interactions with plan sponsors, we continue to hear employees are stressed about student loan debt,” McDonald says. “[Credible] can help you decide whether student loan refinancing makes sense, and help you understand the best approach for your situation.”

As for the benefit portal itself, McDonald says the platform received a major upgrade to its assessment tools and educational content, both of which appraise employees’ financial fitness. After the assessment, employees receive a library of articles, videos and webinars tailored to their unique situation — where they are in their careers and personal lives, in addition to finances. Topics include everything from taxes, retirement, student loans to investing.

“The new digital experience is able to take a robust assessment to let employees know where they are, and provide content to help get them where they want to be,” McDonald says.

Morgan Stanley’s May acquisition of the stock option platform Solium Capital opens the benefit up to tech startups, the software company’s primary customers, McDonald says. While he says the company is excited to serve newer companies, the majority of the platform’s consumers are mid to large-sized employers.

“Every employer has an array of needs within their organization,” McDonald says. “By offering a comprehensive financial wellness product, we’re excited to be able to help all participants.”