FinFit has debuted an employee savings account program that allows employers to make a contribution toward their savings of up to 100%, giving employers a greater opportunity to be instrumental in their employees’ financial well-being.

“Over half of employees can’t meet a $1,000 to $2,000 expense that is outside their ordinary budget,” says David Kilby, CEO of FinFit. “Fifty percent of employees have absolutely no savings. There's a secondary pandemic, and it’s a financial one.”

FinFit, a fintech company that offers a financial wellness benefit platform to more than 150,000 employers, is launching a mobile-first banking solution that will include savings and checking accounts, round-up opportunities, automated savings programs, and recommendations for smart saving decisions.

Employers can choose which savings programs they would like to offer, and the level of contribution that suits them. There will be customizable savings options for each employer, ensuring they can maximize the opportunities they’d like to provide for their employees.

“Part of what we have to accomplish here as much as educating and developing the employees, is providing them with acumen literacy,” Kilby says. “In order to make effective financial decisions, we have to also give them the tools and the resources to actually use those behaviors to accomplish financial goals.”

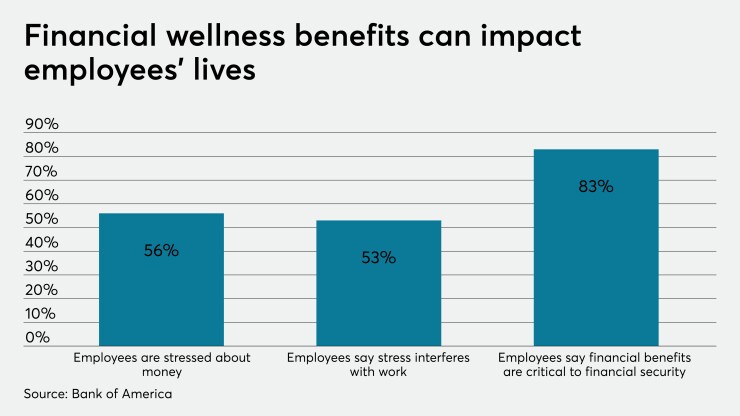

Employers have taken greater responsibility for their employees’ financial well-being. Indeed, 57% of organizations offer workers a retirement investment advice program and 36% offer non-retirement related financial advice, according to research from the Society for Human Resource Management. Employers have recognized that when they help employees make improvements in their lives outside of work, they are rewarded with a more loyal and productive workforce.

“A thoughtful financial wellness program goes beyond benefits offerings and open enrollment season, and instead provides a broad range of time-sensitive support that can meet each individual’s unique circumstances,” says Andrew Frend senior vice president of strategy and product for Voya Employee Benefits. “Financial wellness solutions not only help working Americans make more informed benefits choices during open enrollment season, but also helps them with their financial planning needs all year long — helping to make an impact during their working years and beyond.”