NFP Ventures, the early stage investment branch of insurance broker NFP, has partnered with digital finance platform MoneyLion to provide its employer clients with a financial wellness benefit.

NFP Ventures will provide employers with a suite of financial tools, including MoneyLion’s Instacash program and mobile banking platform, RoarMoney. NFP is the first organization to offer MoneyLion as an employee benefit to employer clients.

“We continue to focus on innovative solutions that align with the needs of our clients, including the challenges of financial wellness that have intensified during these uncertain times,” Shawn Ellis, managing director of NFP Ventures, said in a statement announcing the partnership.

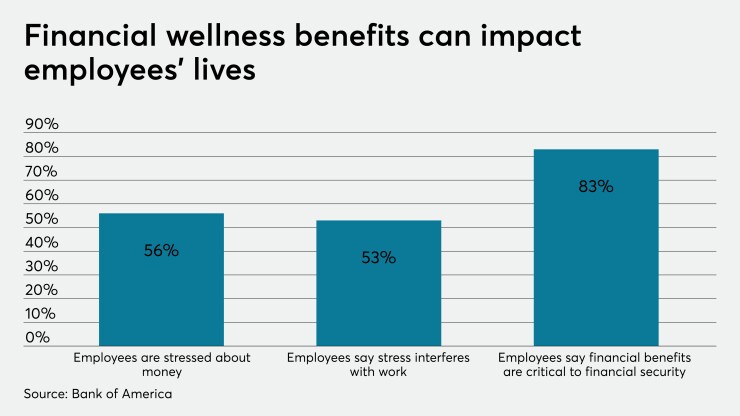

Americans have become more anxious about their financial stability since the outbreak of the coronavirus pandemic, with more than half of employees saying finances or money challenges are their main source of stress, according to PwC’s 2020 Employee Financial Wellness survey. Just 41% of people would be able to cover a $1,000 emergency expense, according to a BankRate poll.

MoneyLion’s Instacash program allows employees to receive a cash advance of up to $250 with 0% APR. This can help employees cover an unexpected expense or even finance a fun opportunity with no interest.

“Employees who may be feeling anxiety about their finances, or need support establishing a plan to save and invest, can easily access the MoneyLion Instacash program, giving employers another resource to support their workforce,” Ellis said.

MoneyLion’s mobile banking feature, RoarMoney, gives employees access to early paydays, advanced mobile wallet capabilities, multiple funding options, price protection, advanced cyber security and near real-time transaction alerts. Employees will also have access to credit building resources, auto investing and a program called MoneyLion Financial Heartbeat, a fitness tracker for financial wellness.

Even before the pandemic took hold, employers were increasingly recognizing the importance of offering financial wellness benefits. Not only are they strong attraction and retention tools, but they help create a more well-rounded and stress-free employee, thus improving productivity rates. Other employers who have added or expanded their financial wellness benefits since the outbreak of COVID-19 include Prudential and

Read More:

“When employers help their employees address significant challenges, loyalty and productivity increase,” Mike Goldman, president and chief operating officer of NFP, said. “Being the first to partner with MoneyLion is another example of how we help our employer clients go beyond traditional benefits and provide access to resources that solve a growing issue for many individuals and families.”