The nation’s largest pension plans showed modest gains in 2017, driven by a roaring stock market and larger employer contributions.

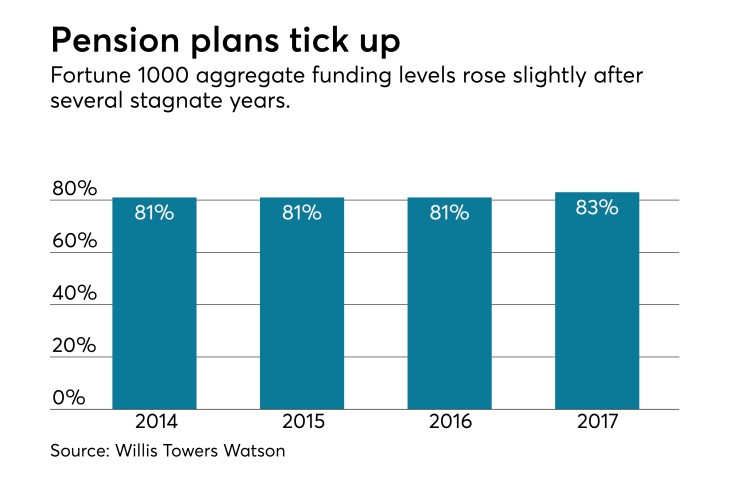

The aggregate pension funded status is estimated to be 83% at the end of 2017, compared with 81% at the end of 2016, according to analysis conducted by Willis Towers Watson.

The pension deficit is projected to have decreased to $292 billion at the end of 2017, compared with a $317 billion deficit by the close of 2016. Pension plan assets rose from $1.33 trillion at the end of 2016 to an estimated $1.43 trillion at the end of last year.

WTW examined data from 389 Fortune 1000 companies that sponsor U.S. defined benefit pension plans and have a December fiscal-year-end date.

“With improved funded status and final tax reform legislation, we anticipate that pension plan sponsors will continue to review and possibly adjust their strategy for managing their defined benefit pension plans. This will involve revisiting projections of financial results reflecting current market conditions and in particular exploring their options from a pension funding perspective to assess whether there is an opportunity to accelerate contributions to take advantage of the 2017 tax rates,” says Beth Ashmore, senior consultant for WTW.

Also see: “

Ashmore adds, “Improved funded status may allow some sponsors to consider further pension de-risking activity. Decisions around pension funding and risk management are inter-related, so it’s important that sponsors consider their options holistically and in conjunction with their broader business strategy.”

A boost

Several factors account for the rise. “Strong stock market performance throughout the year and robust employer contributions to their pension plans helped to boost funded status to its highest level since 2013 after several stagnant years,” says Matthew Siegel, a senior consultant at Willis Towers Watson.

Siegel adds, “Several plan sponsors contributed more to their plans last year than originally expected, most likely in response to rising Pension Benefit Guaranty Corporation premiums and growing interest in de-risking strategies, and potentially in anticipation of lower future corporate rates from tax reform. The improved funding took place when pension discount rates finished the year at a recent historic low, down approximately 50 basis points since the beginning of the year.”

WTW estimated that overall investment returns averaged 13% in 2017, but returns varied widely by asset class. Equities led the pack with returns of 22% while domestic small-/mid-capitalization equities earned 17%. Meanwhile, aggregate bonds delivered a 4% return while long corporate and long government bonds earned 12% and 9%, respectively.