Welcome to Retirement Scan, our daily roundup of retirement news.

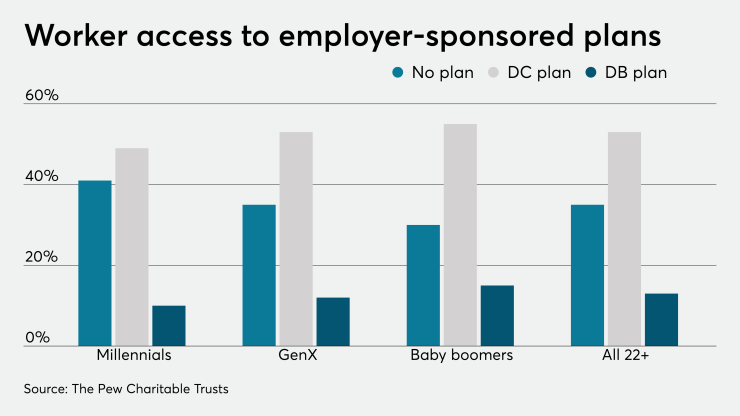

Compared with other generational groups, millennials are in a more disadvantageous position to secure their retirement, according to a study in this MarketWatch article. One disadvantage that millennials face is that while they are expected to live longer than the previous generations, they will need bigger savings to fund a longer retirement horizon, the study found. “There is clearly cause for concern,” the researchers write.

Seniors are better off working past their retirement age and not retiring at all, writes a Forbes contributor, citing a study by the Institute of Economic Affairs. That’s because this option will make depression and illness less likely for older employees, the study found. Working past the retirement age will also allow seniors to delay Social Security and boost their benefit payouts by 8% for every year that they defer the benefit. “Ultimately, what makes working longer worthwhile is the quality of life it gives you. If it contributes to your well being, why give it up entirely?” the expert concludes.

Annuities can be a great strategy for seniors to minimize retirement risk, according to an article from Kiplinger. Employees who want to maximize tax-deferred savings beyond the limits of traditional retirement plans have the option of buying an investment-only variable annuity. A single premium immediate annuity is recommended for clients who want to collect guaranteed income now, while those who opt for guaranteed income in the future can choose a variable annuity, which offers tax-deferral on investments and protection against the risk of outliving their savings.

Workers who are investing in the long term need to rebalance and diversify their retirement portfolio to minimize their exposure to risks, according to an article from CNBC. Target-date funds are a good strategy to achieve this goal, as they are low-cost, tax efficient, easy-to-use options offering “automatic diversification,” says a personal finance coach.