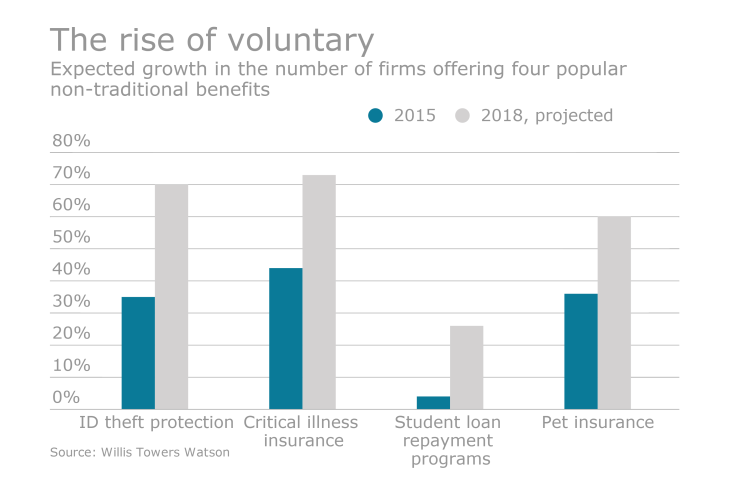

Today, we live in an insurance marketplace defined by healthcare reform, double-digit rising health costs and plenty of unknowns. Given the changing landscape, many HR professionals view their benefit plans as a challenging blend of cost-containment strategies and employee retention. But there’s hope! Perhaps it’s time for a reintroduction, or introduction as the case may be, to a known entity and dynamic insurance duo: self-funding paired with voluntary benefits.

Employers of all sizes have the same goals when it comes to their benefits offering — high quality and affordability. Some companies achieve these goals by cutting costs and going with a self-funded plan and a high-deductible health plan. Yet by pairing with a voluntary benefits offering, at no additional cost to your bottom line, HR professionals could add one-on-one employee communication for enhanced understanding and engagement and additional insurance options tailored to employees’ needs.

Offering a self-funded plan with complementary voluntary benefit products and solutions allows employers to take advantage of multiple opportunities while, at the same time, provide more options for their employees.

Here’s an overview:

· Self-funding helps employers:

· Customize benefit plans specifically designed for their business.

· Adjust components as their organizational needs change.

· Maintain a consistent plan nationwide.

· Avoid state premium tax.

· Not be subjected to state mandates.

· Pay for actual claims, not anticipated claims.

· Be freed from paying reserve requirements.

Now, let’s understand how voluntary benefits can easily, and without added cost, fit into this picture to potentially help HR professionals enhance employee benefit offerings while simplifying your overall administration. And yes, it can actually streamline processes and benefit employees.

Brokers share their go-to supplemental sales partners, including Aflac and Unum, in EBA’s annual VB survey.

Voluntary benefits:

· Help meet employees’ needs by offering select voluntary benefits that complement their plan without adding extra costs.

· Help HR professionals remove manual processes, save time for the department and simplify administrative processes by providing access to a benefits administrative system.

· Help keep employees healthier by putting health and wellness at the forefront with plans that offer benefits and encourage regular screenings and participation in wellness programs.

· Help employees navigate open enrollment by using communication and engagement services to share guidance on the best benefit choices for themselves and their families along with information about any custom company messaging or initiatives.

· Provide peace of mind to employees struggling to fill the gap and keep up with out-of-pocket expenses — all of which can translate to happier, more productive employees.

In today’s constantly changing landscape, self-funded plans paired with voluntary benefits — the dynamic duo — is a formidable combination, and one you might want to consider exploring.