-

Generation Z is favoring Roth accounts like no generation before, new Fidelity research shows.

November 21 -

The country's second-largest bank has unveiled a digital platform for retirement decisions — not on how to save, but how to disburse those savings in a steady, sustainable way.

November 17 -

Companies with 10 or more workers would have to contribute at least 50 cents per hour worked to each employee's retirement account.

November 14 -

Considering expansion of employee access to retirement savings can help millions of Americans have a better chance at a financially secure future.

November 14 Financial Health Network

Financial Health Network -

The industry asked for and received a delay in the rule from the IRS in 2023. Now that it's going into effect, here are the key implications for sponsors and savers.

November 11 -

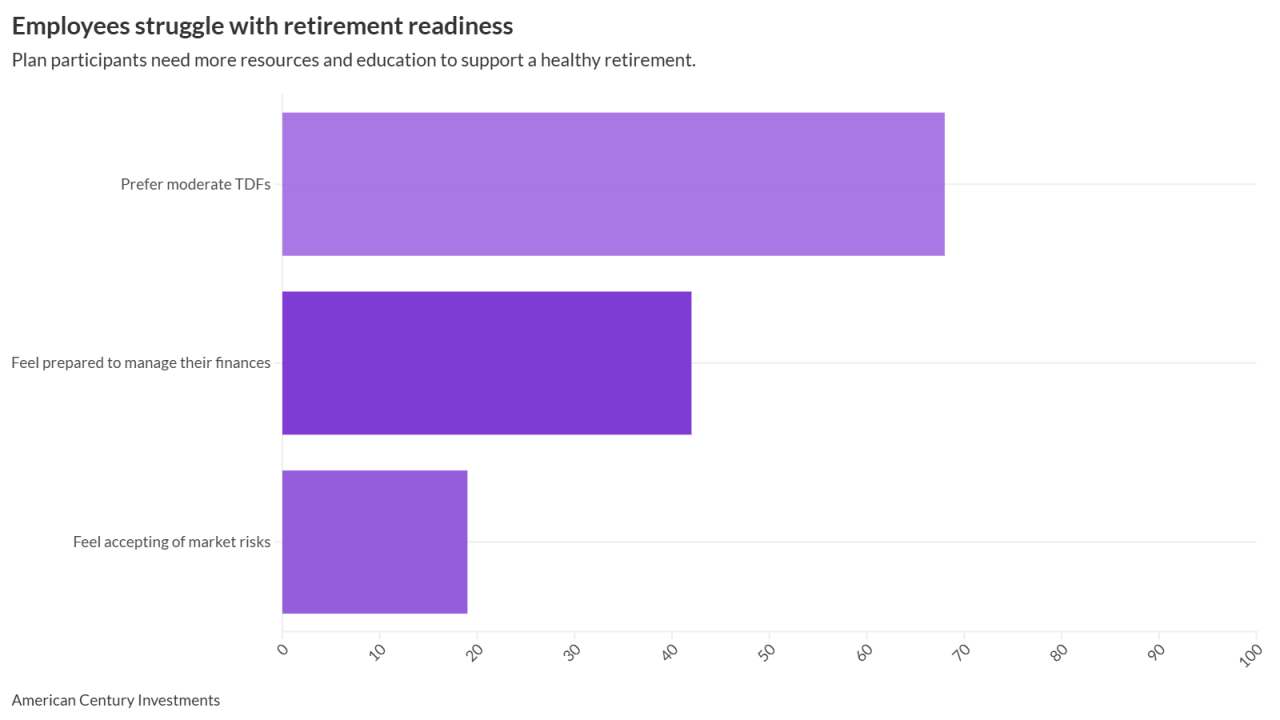

Unaddressed, retirement discrepancies could have a negative impact on employees' saving strategies and set them up for failure.

November 11 -

An expert adviser explains the many considerations to take into account before deciding on this as an option for employees.

October 30

-

A new survey from financial services organization TIAA polled 1,000 adults and found that nearly half don't make enough money to save.

October 20 -

Rising costs and competing financial priorities are making it harder for younger workers to save for retirement.

October 13 -

As 401(k) balances continue to grow, advisers say it's crucial that employees are educated on how to effectively manage their portfolios.

September 25 -

With retirement pressures mounting, Gen Xers and baby boomers are increasing IRA contributions in a bid to catch up, according to a new Fidelity study.

September 10 -

Adopting technology that enables the seamless consolidation of 401(k) accounts at the point of job change can significantly fill the nation's retirement-savings gap.

July 21 Portability Services Network and Retirement Clearinghouse

Portability Services Network and Retirement Clearinghouse -

As college costs rise, parents are resorting to increasingly costly means to pay for their children's educations. The loss in retirement savings is rarely recovered.

July 1 -

More than half of employees rely primarily on their 401(k) plan provider for retirement and financial planning advice.

June 24 -

Retiree income in the U.S. lags far behind the national median for household earnings, but these top cities are bucking the trend, according to a new SmartAsset study.

May 28 -

Novel legal theories and a lower bar for plaintiffs could unleash an explosion in ERISA-based lawsuits against 401(k) plan providers.

April 29 -

Wage growth for job-hoppers is on the decline, but that might be a good thing for long-term retirement savings.

March 31 -

Nearly 84% of U.S.-based plans have an ERISA violation, spotlighting a need for independent benchmarking audits.

March 4 -

Data from Bank of America found employees increased their 401(k) contribution rates in 2024. The right benefits will help advance that trend.

March 4 -

SIMPLE IRAs provide greater investment flexibility than traditional options, making them appealing to employers and employees alike.

January 30