Is becoming a fiduciary adviser good for business? The short answer is, as of middle May, yes.

Let's start by defining what a fiduciary is, and then what it means for an adviser to be a fiduciary. Legally, a "fiduciary" is a person, employer, entity or committee responsible to

That role is a familiar one — from an attorney working for their client or a trustee managing funds for a beneficiary, but it is a big departure from the traditional role of the broker or adviser, which is to be a "producer" — someone charged with selling and

Read more:

Let's next distinguish acting as a fiduciary from actually being a health plan sponsor fiduciary. The latter is a specific ERISA-driven designation with a capital "F." ERISA Fiduciaries are people – but only in the private sector — who specifically make decisions on behalf of the plan (pension or, in this case, health) that they are administering. This designation was originally applied just to pension fund managers, and there were — and still are —

The 2021 Consolidated Appropriations Act known as the CAA clarified what the ERISA law stated for the health benefit as well but never once enforced. It is that designated managers of the health benefit for self-insured employers are ERISA Fiduciaries and personally liable as such. Employee lawsuits may (and recently did) name those individuals as defendants.

Indeed, it appears that many individuals, acting in their work roles, and employers have no idea that they are ERISA Fiduciaries whether they like it or not, or even what that means. Hence, they can get caught in dragnets they didn't know existed.

And to be clear: ignorance is no excuse. An ERISA Fiduciary can't say they didn't know that their broker/adviser was accepting side payments that create or could be perceived to create a conflict of interest. And that brings us to the business case for you to ponder.

Read more:

What it means to be a fiduciary adviser and…

Unlike ERISA Fiduciaries, there is no specific legal definition or prescribed civil liability for advisers who decide to act in a fiduciary capacity. Hence there is no real standard. But a

- You are completely transparent about the compensation you receive for the work you do, whether that is accepting commissions, charging a consulting fee (with an offset for commissions) or similar arrangement.

- Most importantly, you receive "no hidden fees." This seems straightforward, but you need to be relentless on this front. No special deals on pharmacy benefit management (PBM) fees, no under-the-table commissions from vendors or stop-loss carriers.

- If there are overrides or bonuses, you pass them through – or at least disclose or credit them.

- If, unrelated to your engagement,

your firm does paid work for a vendor to "show savings," you disclose that the alleged savings were paid for. - If there

are side deals that benefit your firm even if not you personally, you disclose them. Not just in a press release, but case by case.

… the business case for becoming one

Full disclosure: There's a reason why you think you wouldn't want to act as a fiduciary. In a nutshell, your income will drop.

True, you would sleep better at night knowing that you have your clients' interest at heart, but that's not a "business case." The idea that you tell your client what you make is scary to many people in our industry. It creates direct accountability to your client for your work. There is no schism between what's best for the client and the vendors who sell it.

The business case is that ultimately, a fiduciary adviser will make more money. Further, you should see a reduction in your own errors-and-omissions liability insurance, particularly if you get a third party to attest to, or even guarantee or indemnify, your fiduciary status.

Remarkably, most benefit managers have no idea of all the side deals their "

This is particularly, though far from exclusively, the case with PBM rebates. Indeed, clients of one major Baltimore brokerage firm were shocked, shocked, to learn that the firm had been hoarding rebates. While this particular case (assuming the facts are as alleged by the plaintiff) is especially egregious, hidden fees are likely the rule rather than the exception, especially in consulting firms with enough market power to demand them, as a

By becoming a fiduciary and educating prospects on what that status of yours means for them, you'll encourage them to shine a light on these side deals. Better yet, explain to them their own ERISA Fiduciary liability – and that not knowing their adviser has conflicts and undisclosed income is not a defense. Suggest that all advisers seeking their business should agree – in writing, subject to a substantial self-assessed penalty if they are caught lying – to act as fiduciaries.

Read more:

The one potential roadblock is that all advisory fees should ideally be paid by the actual client, offset by commission-less deals from suppliers. The prospect may say they don't have a large enough consulting budget. That's because the 15% of spend that is administrative seems to be scrutinized much more closely that the 85% paid in claims.

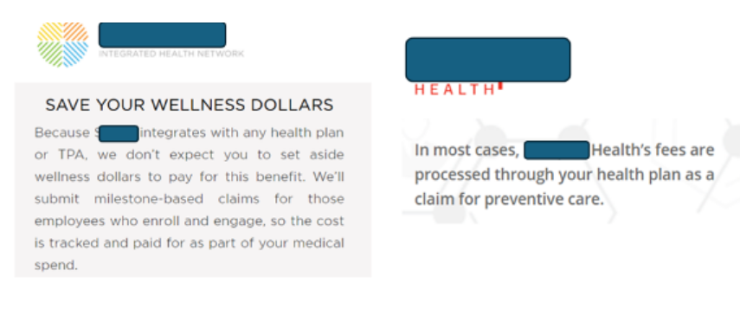

As a sidebar, that market inefficiency is why the large PBMs can charge so much for drugs. They've figured out that rebates credited to the administrative budget are valued much more highly than lower drug prices of the same magnitude. Non-PBMs have figured this out too — you can charge much more by being paid for as a claim:

However, this speedbump can be parried by simply disclosing and crediting your fees received elsewhere to offset your straight consulting fee. Disclosing and crediting accomplishes exactly what a straight consulting fee achieves, but perhaps with much less friction.

Regardless of the compensation method, the future of health benefits belongs to transparency, and nothing is more transparent than acting as a fiduciary adviser.