-

Today, employers need support on many fronts that go beyond a competitive benefits plan, and tech is the glue that pulls these elements together, says Perry Braun.

April 1 Benefit Advisors Network

Benefit Advisors Network -

Employers cite high productivity costs as one-out-of-four employees worry about money issues at work.

April 1 The Financial Literacy Toolbox

The Financial Literacy Toolbox -

With the final rule about to be released, here’s why advisers may regret delaying their preparation for the new regulation.

April 1 SEI Adviser Network

SEI Adviser Network -

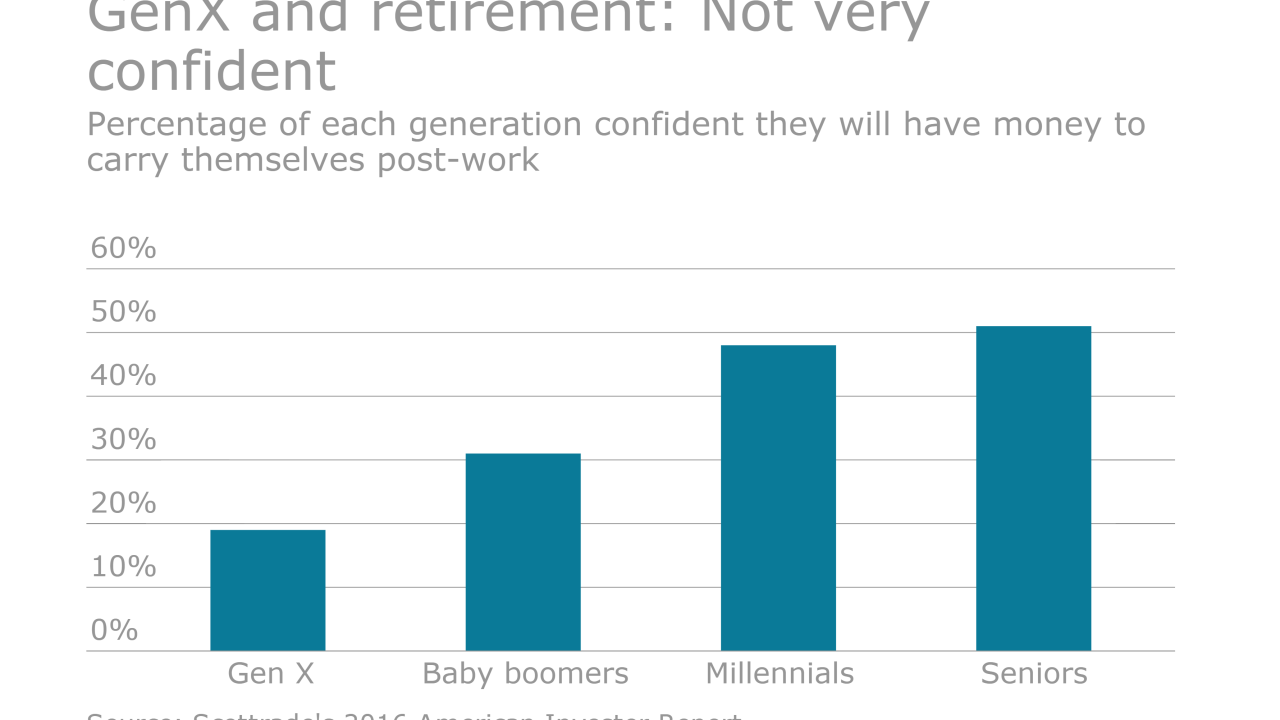

New research from the Insured Retirement Institute reveals that many workers in this age group aren’t feeling very confident about their financial prospects.

April 1 -

Brokers are using tech tools to help model benefit plans and ease enrollment and communications for employers.

April 1 -

New ways advisers can help clients make sound savings and investment decisions.

March 31 -

The DOL’s impending fiduciary rule will accelerate employers’ move toward vetting for experienced brokers, one expert says, adding that a formal process would help plan sponsors better spot suitable firms.

March 31 -

Many lack confidence they’ll ever be able to stop working, but benefit advisers working with employers can help them realize their post-work life goals.

March 31 -

Employers cite high productivity costs as one-out-of-four employees worry about money issues at work.

March 30 The Financial Literacy Toolbox

The Financial Literacy Toolbox -

Regardless of what the final Department of Labor regulations say about fiduciary responsibility, sponsors should not hire or continue to work with an adviser who will not sign on to the plan as a fiduciary.

March 30 Lawton Retirement Plan Consultants

Lawton Retirement Plan Consultants