Commentary about Trumpcare, health savings accounts and leave laws were among the most popular items this year.

EBN’s top blogs of 2017

The following blogs ranked highest in pageviews and still hold important information for employers to revisit going into the New Year.

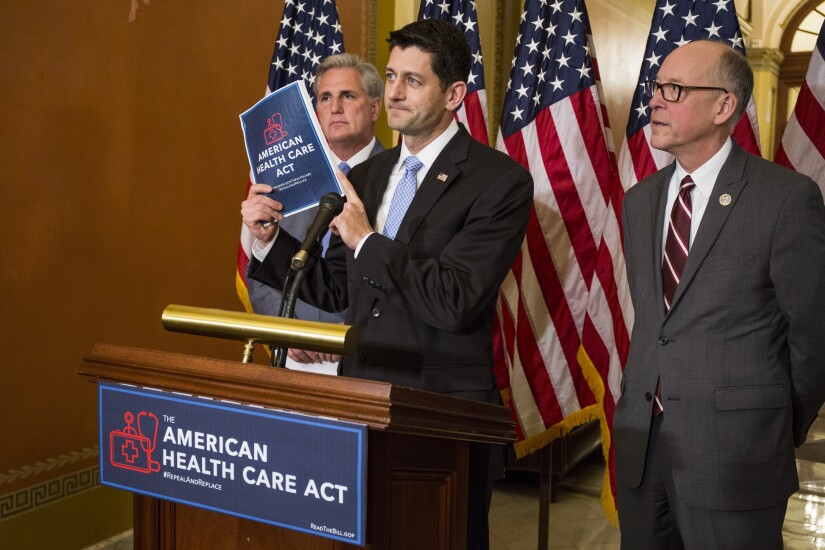

1. 5 ways Trumpcare is likely to change employee benefits

Author: Frenkel Benefits’ Craig Hasday

Excerpt: “Healthcare will continue to be driven through the employers. Cost pressures will continue to press forward the evolution of high-deductible plans, risk-based contracting and consumerism. The biggest challenge will be to facilitate these transitions.”

2. What employers need to tell employees about HSAs

Author: Corporate Synergies’ Loretta Metzger

Excerpt: “To date, employees have largely viewed HSAs as a short-term savings solution — similar to a medical flexible spending account — that offsets medical expenses until they reach their deductible. Importantly, there are a number of differences between FSAs and HSAs, and employers should be sure to help employees understand those differences.”

3. Are employees eligible for leave during a natural disaster?

Author: Jeff Nowak of the law firm Franczek Radelet

Excerpt: “ … an employee would qualify for FMLA leave when, as a result of a natural disaster, the employee suffers a physical or mental illness or injury that meets the definition of a “serious health condition” and renders them unable to perform their job.”

4. What’s in store for workers’ comp under the Trump administration?

Author: MDGuideline’s Joe Guerrierro

Excerpt: “As the industry waits for the dust to settle around coming changes, employee benefit and worker’s comp professionals can count on one thing: the momentum powering value-based care will continue unhindered.”

5. 5 ways the American Health Care Act benefits employers

Author: Consulting firm FirstPerson’s Katy Stowers

Excerpt: “Most of the discussions around the American Health Care Act rage around the more political aspects of the bill, but lost in much of the public debate is the potential impact of the proposed bill on employers — by far the largest source of providing healthcare coverage in the country.”

6. Why HR managers should review their HIPAA procedures

Author: Corporate Synergies’ Harrison Newman

Excerpt: “The increase in audits — combined with everything from changes in technology, the addition of a health and wellness program and concerns about hacking — serve as a good reminder why employers should revisit HIPAA training often to ensure compliance.”

7. Do Roth 401(k)s have the edge over pre-tax 401(k)s?

Author: Lawton Retirement Plan Consultants’ Robert Lawton

Excerpt: “If you believe that tax rates will be higher in the future (and most tax experts do), it would be best to have your contributions taxed now at a lower rate rather than in the future at a higher rate when your balances are distributed. This line of thinking favors making all Roth 401(k) contributions.”

8. Why the ACA replacement bill missed the mark for employers, employees

Author: Vitality Group’s Francois Millard

Excerpt: But the devil is in the details, especially when it comes to how future funding will shape our country’s health. And one key, and often overlooked, aspect is one of the most telling signs of why the United States has such poor health relative to peer countries: the continued focus on healthcare rather than health.”

9. Why employers should pair self-funding with voluntary benefits

Author: Trustmark Voluntary Benefit Solutions’ Dan Johnson and CareSource’s Steve Horvath

Excerpt: “Offering a self-funded plan with complementary voluntary benefit products and solutions allows employers to take advantage of multiple opportunities while, at the same time, provide more options for their employees.”