The voluntary market has grown by leaps and bounds, up 3.32% and garnering over $1 billion last year, according to data analytics firm miEdge.

The biggest boon for the industry stems from the Affordable Care Act and its mandated benefit requirements. “The ACA forced brokers and employers to look for every advantage, [which meant] getting comfortable with voluntary,” says Jeff Spahr, vice president of Anthem Specialty Business. Anthem had a 13.58% increase in voluntary growth in the large-group market, earning more than $13 million from companies with at least 100 employees last year, according to miEdge.

Data, collected by miEdge, are based on Form 5500 Schedule A data submitted to the Department of Labor. As such, groups under 100 lives, government entities and church plans are not required to file. Any disclosure on Schedule C’s are not contemplated in these numbers.

Principal Financial Group has also seen a huge uptick in voluntary sales (up 20.83% and $14 million last year, according to miEdge). In the past year, voluntary accounts for 40% of all their new sales.

“As of late, some of that growth has stemmed from changes within the ACA. It’s also due to the evolution of exchanges and employers becoming more educated about the different options available.

“[Employers are] looking to cost shift some of those expenses from the medical increases they’re experiencing and so are looking to provide ancillary benefits on a contributory or voluntary basis. That’s rung true at Principal and pretty much in our industry as a whole,” says Sean McCartney, national vice president of specialty benefits distribution at Principal.

The ACA now requires pediatric dental care for children up to age 19. “This requirement has also created another market for dental benefits. But in general, it’s an overall, increasing knowledge of medical and ancillary benefits as a way to bring value and retain employees,” says McCartney.

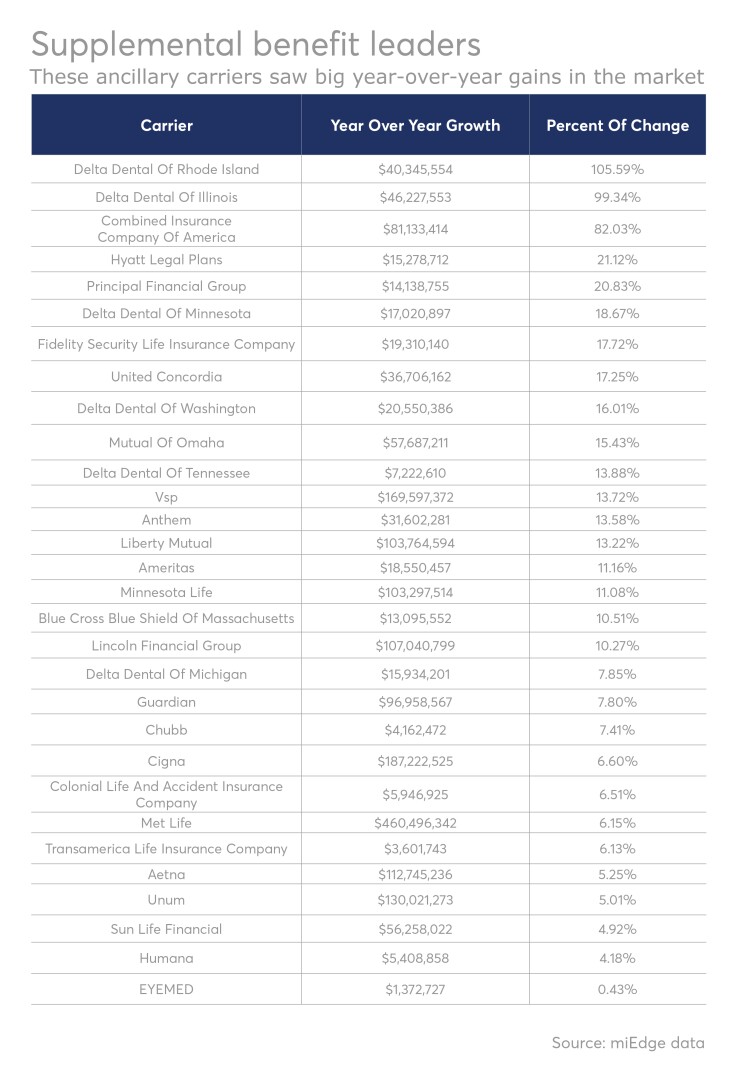

For specialty dental carriers, that’s meant huge increases. The top two earners in the voluntary industry were Delta Dental of Rhode Island and of Illinois, according to the list compiled by miEdge.

“Not even including the Covered Illinois exchange, our individual product has grown by 30% from last year to this year,” says Karyn Glogowski, vice president of sales and service at Delta Dental of Illinois.

Glogowski and others have suggested that the ACA has spurred voluntary growth both directly, with dental and vision insurance, as well as indirectly for ancillary products outside the healthcare space, simply due to the spotlight cast on benefits.

The top five grossers in voluntary benefits, according to miEdge, were Delta Dental of Rhode Island (up 105.59% and over $40 million), Delta Dental of Illinois (up 99.34% and over $46 million), Combined Insurance Company of America (up 82.03% and over $81 million), Hyatt Legal Plans (up 21.12% and over $15 million), and Principal Financial Group (up 20.83% and over $14 million).

So, how did they do it? EBA spoke with some of these top carriers, ranging the gamut of voluntary products, to find out what they attribute to their success and the industry’s success as a whole.

Delta Dental of Illinois

Dental benefits have seen the strongest growth of voluntary products, mainly due to new benefits requirements under the ACA.

Glowgoski saw this opportunity from the get-go and immediately began partnering with medical carriers to build their business in a post-ACA world. “A few years ago, my sales strategy was to partner with a medical carrier so that we could couple our dental offering with their medical offering. [That way], they would have a compliant plan that they could present to the market,” she explains.

Delta Dental of Illinois included their pediatric dental benefit (an ACA certified plan) with plans from medical-only providers in central Illinois. “That partnership has yielded us quite a bit of business,” Glowgoski says.

They’ve also entered several private exchanges and have looked into Internet opportunities, like dentalplans.com, to attract more new customers.

However, rising medical costs pose a threat to the dental carrier industry. If the cost of medical insurance continues to increase and the employee has a limited budget, then medical will take precedent and they may drop dental or move to a lesser plan. “[Employees will] eliminate dental before they eliminate medical,” she says.

The trick is to show employers that dental helps lower those medical costs in order to convince their employees. For example, those with chronic conditions can get the additional cleanings they need without any additional cost. So diabetics can get four cleanings a year, “which we know from a clinical perspective is advantageous for the overall health of that individual,” Glowgoski explains.

More than 95% of their business comes through the broker and consultant community, so she attributes much of their success to their strong relationships with benefit brokers. “We work very closely with the broker community. We think that’s an invaluable channel and a critical community to access their expertise in making these decisions,” Glowgoski explains.

Principal

The financial firm has also seen its most promising growth from its dental sector. But they’re also seeing increased profits from their worksite products, both the more individualized products and the typical ancillary offerings.

“We’re starting to see a lot more employer interest, even in the smaller business space, in things like critical illness and accident [insurance]. And some of the other non-traditional benefits like legal have started to trickle down [to the smaller group market],” says McCartney, national vice president of specialty benefits distribution at Principal.

To continue to attract the small- and mid-sized market, where Principal focuses their sales, they’ve been focusing more on technology than “sheer product enhancement,” he explains.

“We’ve done a lot with technology and efficiencies to ensure that we can handle those types of volumes and support the growth you see with the miEdge numbers,” he adds.

Principal only sells its products through brokers, and efficiency in technology attracts brokers, as well as localized support. A local sales and account management model is the pillar of their broker-centric strategy.

“It’s so important for brokers to have access to local expertise and touchpoints that understand their specific market and geography, as opposed to phoning a national 1-800 number,” he explains.

Wallet share is a big concern for Principal as well, and all voluntary vendors — after paying for medical, will an employee decide to spend on other insurance products? “Medical comes first, and unfortunately, may take up 90% of mind space, but I think we’re beginning to see a shift where voluntary becomes more popular,” he says.

Rebranding voluntary insurance options as “paycheck insurance” is a great way to explain these benefits value to employees, suggests McCartney.

Anthem

Spahr, vice president of Anthem Specialty Business, believes their key to success is ‘groupification.’ Whereas before the ancillary industry consisted mostly of individual carriers, now group carriers have started offering the gamut, which he believes, makes life simpler for the employer and the broker.

“Almost all of the growth over the last four to five years has really come from group products and carriers,” he says.

He believes that one carrier offering the bulk of medical and voluntary products is helpful on the technological and administrative side, as well as makes for better population management.

“We’ve been connecting the clinical data on the back end so that not only can the employer offer all these different options, they can get better health outcomes, lower the total cost of care and really improve the experience for everyone.”

This integration allows Anthem to identify consumers with chronic conditions and who are at high risk. They can then reach out to them and their provider to let them know they’re giving them additional benefits, and they can further monitor whether the individuals are using those benefits. If not, they can reach out again.

Anthem has had the greatest success with vision and dental products, especially since implementing the integrated care concept.

Spahr says that term life and optional life continue to be bellwethers of the voluntary industry and that the industry has seen double-digit growth rates in critical illness and accident coverage in recent years, though they don’t currently offer them.

From an employee’s perspective, voluntary products are competing with their cable or phone bill, which are necessities for most consumers, so it’s up to the carrier, broker and employer to explain the value of buying these products alongside their utilities and basic medical. ”Choice is good, but at some point offering too much can turn employees off and it can also be a little more difficult to administer,” he explains.

That’s where a strong broker comes in who knows their client’s demographic and needs so they don’t overload them. “Leveraging the employer as a distribution channel through benefit brokers rather than selling policies one off” has been a boon for individuals buying ancillary benefits, he says.

Hyatt Legal Plans

Legal insurance may be outside the normal core of voluntary benefits an employer offers, but Hyatt Legal Plans is growing, and fast. “The roots of [voluntary benefits success is] the shift in employers needing to [move] the larger cost of benefits onto employees, but it’s also the culture of the workplace wanting to offer a robust employee benefits package. I definitely see that in the legal space because it’s not as intuitive a benefit as say, accident or critical illness. But for employers who are thinking about the holistic wellness of their employees, not just in terms of health, but also finical wellbeing, then voluntary benefits fit well into that portfolio,” explains Ingrid Tolentino, CEO of Hyatt Legal Plans, a subsidiary of Met Life.

She too attributes part of their success and growth to the ACA, which has had “an indirect impact on voluntary benefits like legal by honing that spotlight on the industry as a whole,” she explains.

For legal insurance, the challenge lies in conveying value to employees who may not see a need for a lawyer until they desperately need one.

The ranking, featuring dental, vision and voluntary benefit companies, is based on year-over-year revenue data compiled by analytics firm miEdge.

“The value proposition of the legal plan [is best served by] matching it with [individuals’] life stages,” Tolentino says.

For example: wills. Employees taking care of their parents can understand this as a real need to protect their family. Only 40% of Americans have a will, according to a Harris Poll study conducted on behalf of Hyatt Legal Plans in 2015.

By addressing this need, brokers can easily make the case for legal plans in a company’s portfolio by helping employees see its value in perspective.

Hyatt’s legal benefit helps employees with refinancing, estate resolution, tax issues, traffic tickets, adoption, custody issues and even divorce. Since it’s a limited enrollment window, “our success depends on how involved the broker and employer is in communicating the value of the benefit,” says Tolentino.

“Our challenge is making sure we can communicate the value of having legal insurance and the advantage of having a qualified attorney versus downloading forms from LegalZoom,” she adds.

Their communication strategy is yearlong, so that when open enrollment comes along, the benefits’ value is top of mind for employees. For such a benefit, brokers and employers could have discussions during tax time; for example, when employees are feeling the pinch and could see firsthand the relief such a benefit would offer them.

“Brokers have become indispensable in that space [in conveying the value of our product to employers],” says Tolentino, who adds, “I certainly advise brokers to look into how voluntary benefits [and legal benefits] could round out the wellness portfolio that they offer their clients.”