Employees dread open enrollment almost as much as they dread renewing their driver's license or passport.

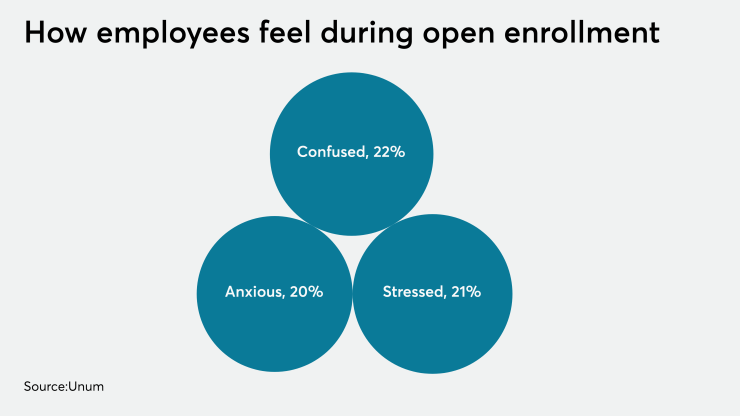

Indeed, some 45% of workers say they are apprehensive about the open enrollment process — the same number fear asking for a raise and slightly more fret over renewing their passport or license, a recent survey from MetLife found.

Meredith Ryan-Reid, senior vice president of group benefits at MetLife, says much of this feeling is because employees still don’t know enough about their benefits when they’re enrolling. Employees don’t always get enough context on the plans that are right for them when they’re signing up, she adds.

“Employers are increasingly interested in figuring out what’s going to resonate with employees,” she says. “They want to be careful that they’re not being too suggestive either.”

See also:

Research finds that employees often don’t spend time preparing for open enrollment. For example, last year

To help make open enrollment easier for workers, employers may want to invest in more personalized benefit communication strategies. Some 72% of employees say having customized benefits to meet their needs would increase their loyalty to their employer, MetLife found in its most recent Employee Benefits Trends study. If employers want to up their engagement during open enrollment, they may want to consider creating a more personal strategy.

“I think so many people still aren’t making the connections between the options made available to them and which ones they should choose and why,” Ryan-Reid says. “There’s not always a lot of personalization and context.”

Improving communications strategies and accessing new tools can be a helpful way for employers to make open enrollment more personal for workers. But leaning on a broker can also be helpful, she adds. Many brokers hold group meetings or set up digital tools to create a more seamless enrollment process. Varying communications is always a useful strategy.

“The brokers have been playing an increasingly active role, and they’ve been making introductions to various third parties in enrollment,” she says.

See also:

Ryan-Reid is optimistic that employers will be able to close the gaps that exist in benefits enrollment, but it may take some time. But first, employers need to re-educate workers every year about benefits instead of assuming they remember how to enroll from the year before.

“Companies [should] figure out how to truly engage workers at relevant moments throughout the year,” she says. “The work is never fully done.”