VRI, a hospital and healthcare patient monitoring technology provider, has teamed up with Tuition.io to offer its 300 employees a student loan repayment benefit.

The program is set up so employees can pay down their college loans while also saving for retirement. Some employees may feel they need to put off their retirement savings in order to get a handle on this debt, not realizing how much of a detriment that is to their future financial security.

Indeed, 75% of respondents to an IonTuition survey said they would rather their employer offer monthly contributions to their student loans over 401(k) benefits.

“Many of our team members have invested in themselves through further education, but the burden of that student loan debt has prevented them from preparing for retirement,” says VRI CEO Jason Anderson. “VRI’s decision to expand our benefits package to include student loan repayment is rooted in both the feedback from our team members and our desire to set them up for success now and through retirement.”

A further 73% of student loan borrowers report that they are putting off maximizing their retirement savings, saying they expect to begin or increase their contributions once their student loans are paid off, according to a TIAA-MIT AgeLab study. Among those who are not saving for retirement, 26% point to the need to pay off student loan debt as the reason.

To be eligible for the student loan repayment benefit, employees must be participating in VRI’s 401(k) program, which the company matches up to 4%. Once an employee contributes to their 401(k), VRI will match the contribution and also pay $50 toward the employee’s student debt each month.

More than 10% of VRI employees have registered with Tuition.io and connected their student loan accounts for receipt of the monthly benefit, Anderson says.

“I am cutting two years off of my loans with this benefit,” says Amber Long, VRI workforce manager. “It’s exciting to feel like I am planning for my future. Watching my loan go down while my 401(k) savings goes up is a huge relief.”

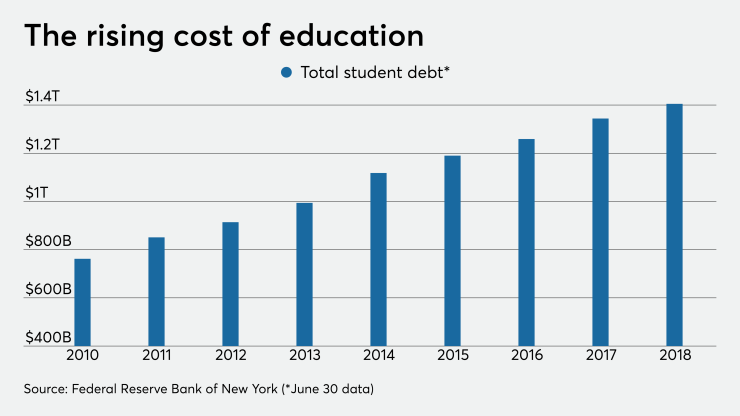

Student loan debt has ballooned to over $1.6 trillion in the U.S., according to the Federal Reserve. About 8% of employers offer their staff a student debt payment benefit, according to the Society for Human Resource Management. Though still low, that figure has doubled since 2018.

“The financial burden of student loans is a major reason fewer employees are taking advantage of 401(k) programs despite a majority of companies offering the benefit,” says Scott Thompson, CEO of Tuition.io, noting that nearly 20% of Americans carry student debt. “VRI understands today’s workers are no longer looking for simple retirement benefits because financial obligations such as student loan debt take immediate precedent.”