If current trends continue, approximately 104 million women will cash out almost $800 billion in retirement savings, in today’s dollars, over the next generation.

This eye-popping statistic, presented at a “Women and Retirement Income” roundtable discussion on May 22 sponsored by the Women’s Institute for a Secure Retirement, underscores the importance of financial wellness initiatives by plan sponsors to help women participants avoid cash-outs and instead

An estimated 5.9 million women participants in defined contribution plans will change jobs each year, and 41% (2.4 million) of them will cash out $28 billion in retirement savings, incurring penalties and taxes. These findings, and the one mentioned at the beginning of this article, are based on industry research on cash-out leakage, participant turnover rates, and women’s participation in defined contribution plans, as well as the

However, another finding indicates that women participants who have sub-$5,000 401(k) savings balances are at higher risk of cashing out upon changing jobs than their male counterparts. According to

Thankfully, research also demonstrates that the implementation of auto-portability — the routine, standardized and automated movement of a plan participant’s 401(k) savings account from their former employer’s plan to an active account in their current employer’s plan — can help women participants avoid cashing out and save more for retirement. Our analysis indicates that preserving just one $5,000 401(k) balance at age 25 can result in $70,000 in savings upon retirement — and preserving three $5,000 401(k) balances over the length of a participant’s working life can generate an additional $123,600 in retirement savings.

Putting women on par with men to achieve financial wellness

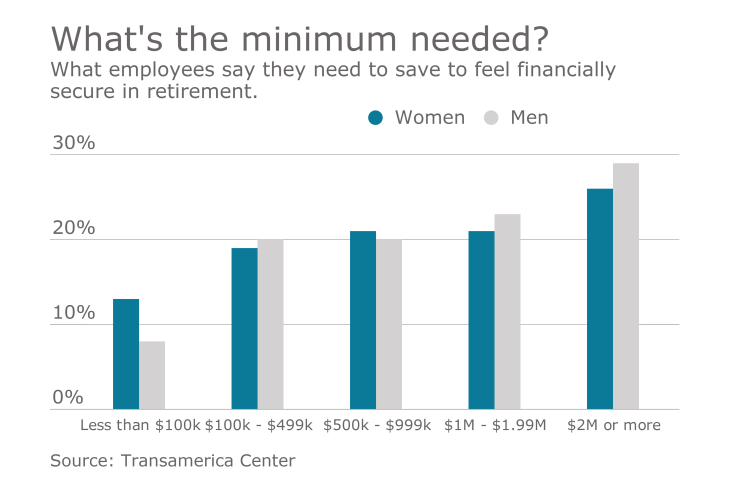

For a variety of reasons, women have to work harder than men to save for a financially secure retirement, and obtain overall

Sponsors can take the initiative to help women participants save more for retirement, and potentially increase their standing with regulators, by encouraging and facilitating account consolidation, including the adoption of auto-portability for small balances. Consolidation is the key to reducing missing participants through removing redundant accounts from the retirement system. Approximately 67% of stale address records for lost/missing participants can be matched up to active address records in plan record-keepers’ records, according to Mr. Cormier’s recently published study,

With auto-portability having been in operation for nearly a whole year, this solution has a viable track record of helping plan sponsors reduce missing participants and

By making it easier for women participants to preserve their 401(k) savings in the retirement system, and/or consolidate their 401(k) savings as they change jobs,

Auto-portability can position millions of hardworking American women to achieve better retirement outcomes. It’s up to plan sponsors to offer the tools and guidance to help women participants consolidate their 401(k) savings, and avoid cashing out, throughout their working lives.