Whether your company has five employees or 50,000, chances are your employees and their children are dealing with student loan debt.

About

There are two major components to student loan assistant benefit programs: resources and contributions.Offering student loan management resources to employees provides them with access to experts who can help them navigate a complicated area. Should they restructure, refinance or apply for loan forgiveness? And once they make the decision, who can they rely on to guide them through the process? More and more employers are seeing the value of offering this benefit, which they can make available to their entire population for a nominal cost.

Employers who want to take their support a step further may want to look into student loan contribution programs. Still relatively nascent, student loan pay-down programs are in high demand: A

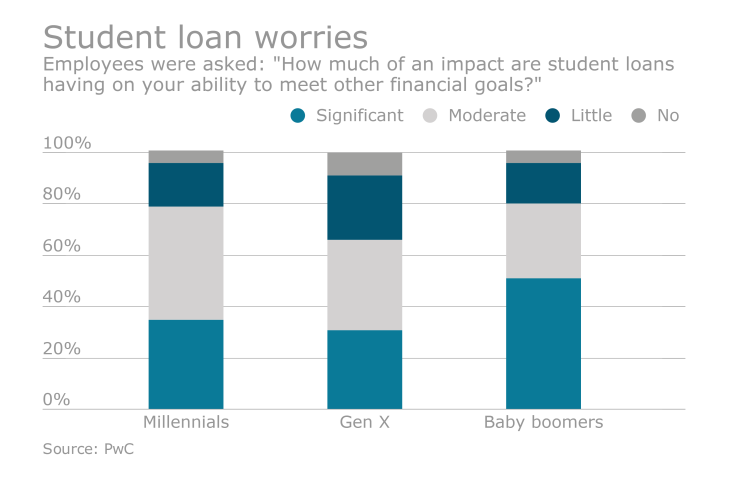

However, today’s student loan repayment concerns aren’t one-size-fits-all. While some employees are worried about their outstanding student loan debt, others are struggling with finding ways to keep college debt at bay. For these employees, helping their children avoid falling into the same trap that earlier generations fell into is what keeps them up at night. For these employees, programs such as

Including student loan management programs as part of your employee benefits can give your business a competitive edge. It will show you’re innovative and aware of the wide range of your employee’s needs — from recent college graduates looking for student loan repayment assistance to parents of teenagers needing help navigating the tricky financial aid process. In doing so, current and potential employees will see that you are committed to their financial wellness and offer a full suite of options to help pay for college, from pre-application planning to post-graduation payoff. The result? You’ll have more satisfied employees and a key talking point to attract new ones, which can help