Regulation and compliance

Regulation and compliance

-

With dozens of state and federal agencies enforcing hundreds of employment and benefits-related laws, the administrative burden of running a company can be overwhelming.

February 25 -

Regulation is poised to impact much of what a broker does, making meetings with legislators ever more important.

February 25 -

Despite being delayed until 2020, the Affordable Care Act’s so-called Cadillac tax on high-cost plans is still on the horizon and employers need to prepare for it.

February 24 -

How advisers can assist their clients with the implementation of the required preventative service.

February 22 -

Do employer clients need to give individuals receiving disability payments an offer of health plan coverage?

February 22 -

The Supreme Court Justice’s passing calls into question the future of some benefits-related decisions.

February 19 -

An initial consultation with a registered dietitian can cost as much as $200. Multiply this by the growing number of overweight and at-risk Americans, and employers could face a considerable cost increase.

February 19 -

The passing of Supreme Court Justice Antonin Scalia throws employers into a world of uncertainty. While Supreme Court jurisprudence is often unpredictable, Justice Scalia’s death will no doubt lead to an unusual amount of turmoil for the foreseeable future.

February 18 -

Those who adapt to the new environment will gain market share and maintain high profitability, says one expert.

February 18 -

There are distinct nuances in each candidate’s position. Importantly for employers, all of the remaining candidates say they intend to repeal the Cadillac tax.

February 17 -

The fate of the ACA’s excise tax notwithstanding, employers continue to look at an array of options to rein in their healthcare costs.

February 17 -

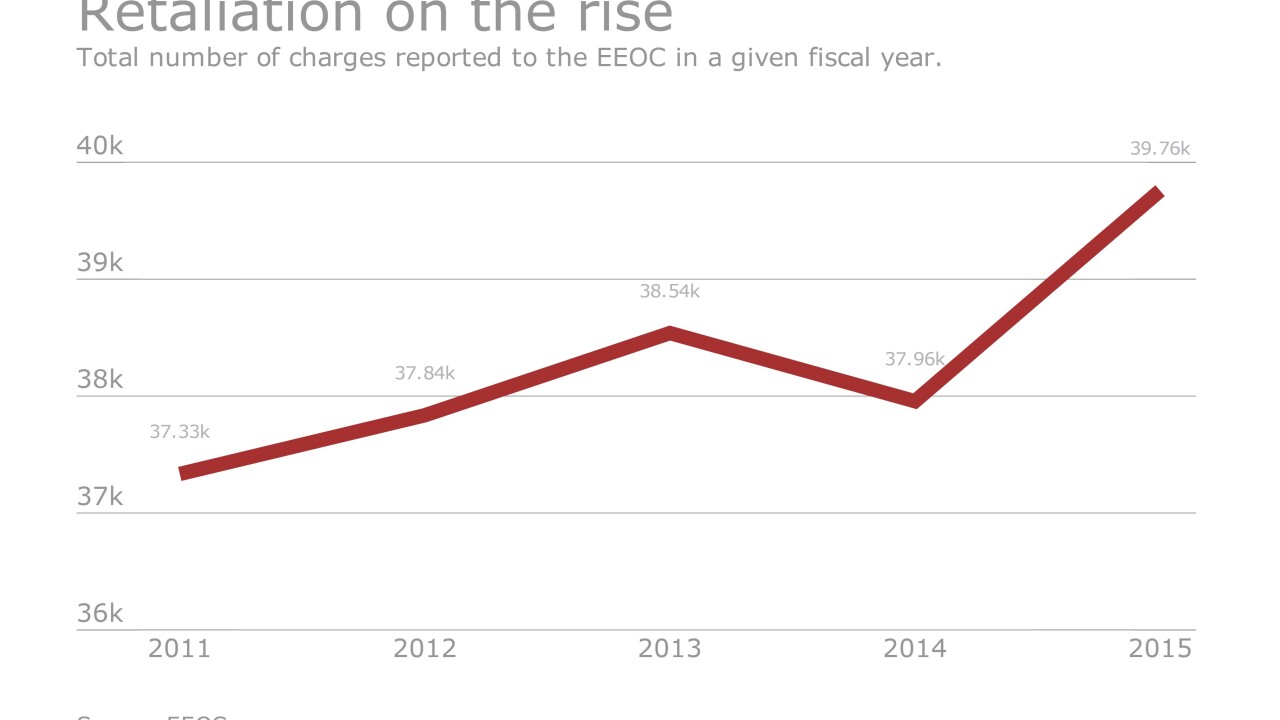

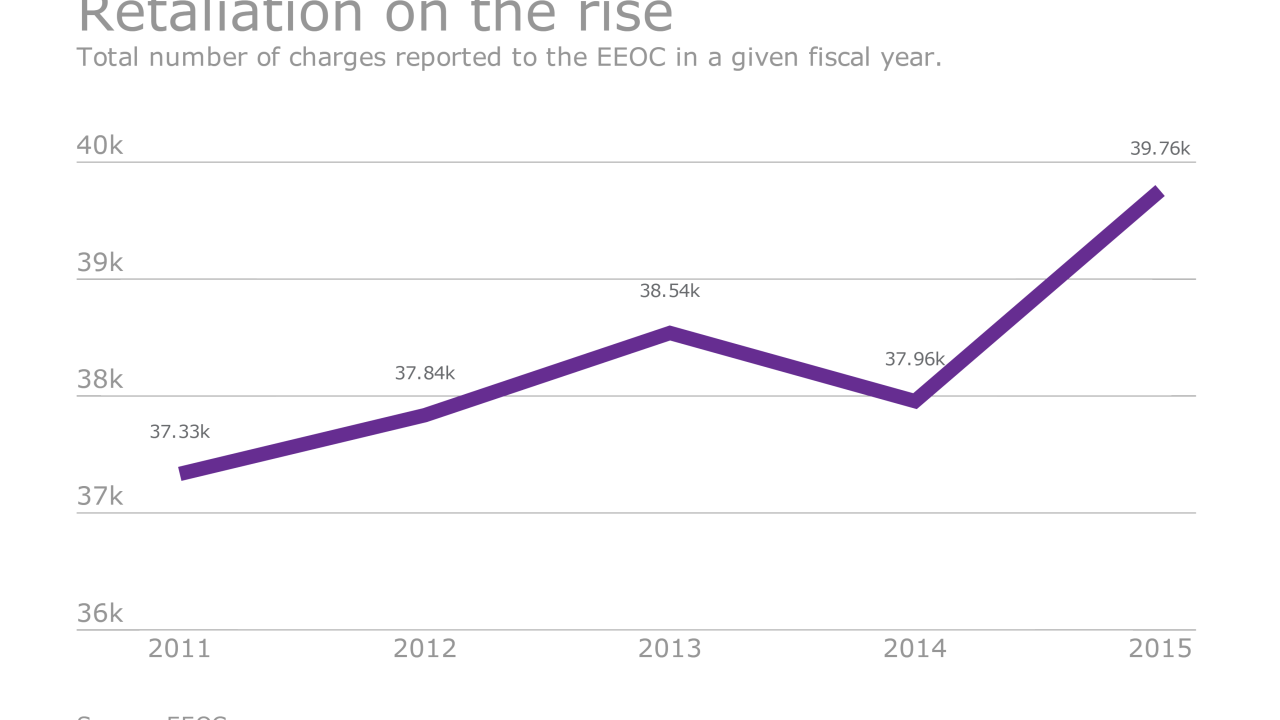

Under the proposal, the agency expands its list of the evidence or facts that an employee can show to show establish a retaliation claim.

February 16 -

The bipartisan Senate bill 1661 represents a way out of the crisis. But getting congress to pass it will require all of our efforts.

February 16 -

Despite expected hurdles, congressional representatives, including Sen. Martin Heinrich, tell CIAB legislative summit attendees, "We will get a repeal done."

February 12 -

Concerns about the ACA’s excise tax remain, but high plan expenses are the bigger problem

February 12 -

In joint guidance issued last week the DOL, Treasury and HHS clarified the application of health care reform provisions on student health coverage.

February 12 -

Under the proposal, the agency expands its list of the evidence or facts that an employee can show to show establish a retaliation claim.

February 11 -

Despite expected hurdles, congressional representatives, including Sen. Martin Heinrich, tell CIAB legislative summit attendees, ‘We will get a repeal done.’

February 11 -

The plan includes discussion of auto IRAs, state-run 401(k) plans and personal IRAs that would be available to Americans through the workplace.

February 10 -

Understanding ACA compliance is critical, but it mustn’t come at the expense of fundamental employee education.

February 5