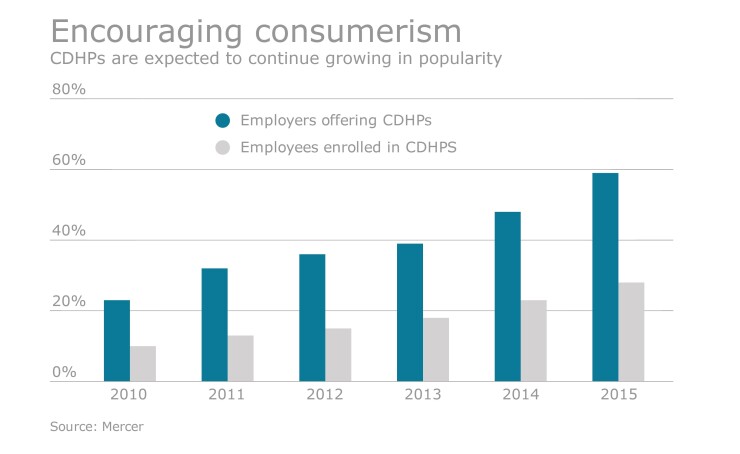

A new, more cost-effective approach to Consumer Driven Health Plans is emerging and should gain even more traction this year and next.

Here’s how it works:

As CDHP enrollment in has grown, it has become more costly for employers to continue funding low payroll deductions and high Health Savings Accounts contributions for their employees. At the same time, employee HSA contributions have lagged, leaving many exposed to the risk of high deductibles.

This new emerging strategy is based on reducing employer HSA contributions in favor of employer-funded indemnity products, such as Accident, Critical Illness and Hospital Indemnity Insurance.

Like voluntary but different

While similar to voluntary insurance offerings, there are some important differences. To simplify administration and billing for employers, these products were moved from an individual platform to a group chassis. Also, to align their benefits more closely with the risk created by the CDHPs’ higher deductibles, these new indemnity products tend to have lower coverage amounts and fewer coverage choices.

The lower face amounts on the policies are reflected in a lower average cost, which appeals to employers. Also, certain types of coverage that employers have been trying to discourage (i.e. emergency room visits) have been reduced or eliminated. In addition, the simplified plan designs and lower face amounts have eliminated the need for underwriting, so enrollment is much simpler and requires less administrative work on the part of the employer.

An added advantage is that these products tend to be “non-inflationary.” By redirecting their funding from high inflationary medical premiums and HSA contributions, which are linked to growing deductibles, this strategy provides financial protection but with greater price stability. As a result, employers view this approach as more sustainable over time.

"The lower face amounts on the policies are reflected in a lower average cost, which appeals to employers."

Where do we see this benefits model headed? No doubt regulators will continue to look at these “excepted” benefits as they formulate policy around Cadillac Tax computation and ACA compliance. But barring significant changes to the way these benefits are currently treated, we expect to see a continued evolution in the design of employer-funded indemnity products to better align with sponsor objectives. Likewise, advisers will integrate this strategy into their benefit planning for 2017.

As with other shifts to the value proposition of an employer benefit plan, advisers must help their clients contend with the communication, enrollment and administrative challenges that ensue. Procedures and systems already in place may not be up to the challenge, and advisers will have to develop new approaches if their clients are to reap the benefits of this new approach.