As the cost of healthcare has soared and addressing the needs of an increasingly diverse workforce has become more complex, many employers are considering moving away from an employer-driven benefits model to a consumer-driven, defined contribution approach.

Fueling this transition is the proliferation of private exchanges. These online marketplaces set prices, provide plan specifics and help employees make personal buying decisions with the help of decision support tools and, in many instances, phone support through call centers. In addition to health insurance, they also offer other types of employee benefits, such as life, disability, dental and even pet insurance.

Proponents of offering a defined contribution benefits program through a private exchange include the many technology companies that developed private exchange offerings. They maintain that these platforms afford employers the opportunity to predictably set their healthcare costs and reduce their administrative expenses, while offering more choices to their employees.

Overstated advantages

There are those in the health insurance industry, however, who believe that the advantages of private exchanges are overstated, and that investors who have spent millions building the technology are simply trying to earn a return by repackaging existing solutions. For instance, many large plan sponsors have been offering online enrollment and employee education for years. Existing benefit administration and HRIS products from payroll vendors have been providing the same type of plan choices and employee education through many renewal cycles.

Moreover, some healthcare economists argue that the value proposition of a private exchange is ambiguous and question whether they provide any real savings. The number one benefit of a defined contribution plan offered through a private exchange is purported to be cost savings. But a technology platform alone does not address the underlying drivers of escalating healthcare costs, which are increased utilization by an aging workforce in tandem with medical inflation. Initial cost savings are typically achieved by increasing the participant’s contribution for certain plans, effectively shifting costs to employees and their families. Steerage, the strategy used by plan sponsors to entice consumers to choose lower cost options, can backfire if employees choose the wrong plan solely based upon cost and end up in financial trouble due to higher out of pocket expenses.

"As much as technology companies want your clients to believe that private exchanges are preassembled, very easy to deploy and inexpensive, the real story is more complex."

There is also implementation to consider. As much as technology companies want your clients to believe that private exchanges are preassembled, very easy to deploy and inexpensive, the real story is more complex.

For instance, experience-rated, larger plan sponsors with generally more than 100 employees must go through medical underwriting to obtain plan pricing. Underwriting includes an analysis of the population’s demographics, family content, claims history, industry and geographic location. Only after pricing is established and enrollment assumptions are made can a plan sponsor develop the proper contribution strategy.

Project timelines of 6-8 months for installation are not unusual, and monthly fees to run the exchange can be substantial. These include the electronic feeds that must be established to the exchange offerings’ various insurers. Also, because exchanges are such a new concept, employee education is very important and a robust communications effort is required to ensure that they are comfortable using the platform during open enrollment.

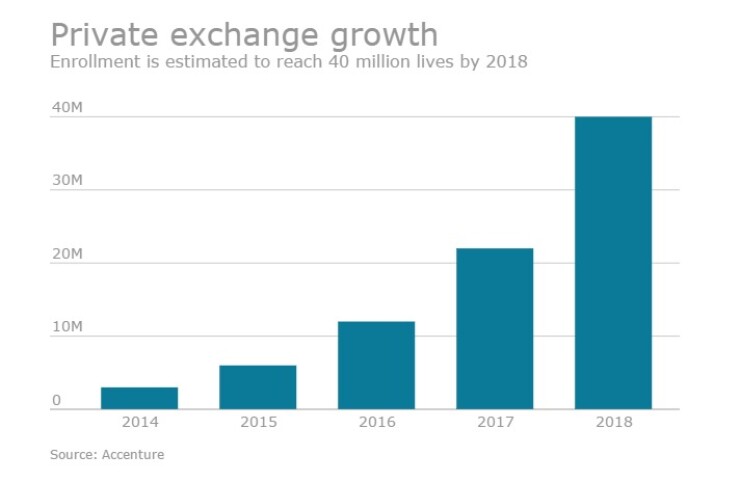

Private benefit exchanges expect massive growth in the next few years. These executives from all parts of the industry are leaders in the space, forecasting trends and serving as ushers for what some are calling a new era of health care.

If your client is an innovative employer looking to fix its contribution to medical insurance, while allowing a diverse population of employees to design their own benefit programs to meet their own personal and financial needs, then a private exchange is an option the client should consider.

After considering the pros and cons, employers who decide to move ahead with a defined contribution model delivered through a private exchange will have a wide variety of vendors to choose from. Advisers should be prepared to help them evaluate the market and conduct a competitive RFP process.