Employers have taken a greater interest in their employees’ financial wellness by offering benefits including student loan repayment, financial adviser services and instant wage access. But there is one financial wellness benefit that may actually be causing employees more stress.

This benefit is the 401(k) loan, which employers can offer to their workforce in case of a financial emergency. Indeed, 20% of all 401(k) participants currently have an outstanding loan, according to data from Fidelity Investments. Yet the possibility of not being able to pay back this loan is causing employees greater stress, according to a new study by Custodia Financial and Greenwald & Associates. The study found that 91% of employees value the chance to borrow from their 401(k) plans, yet 70% believe that losing their job would make it more difficult to pay back a 401(k) loan.

“401(k) loans have their advantages and disadvantages. It makes sense if [employees] have a short term liquidity need [and they] can pay back the loan in less than a year,” says Deborah Badillo, a certified financial planner with the Lubitz Financial Group. “401(K) loans are better than a payday loan with high interest. The one caveat is that if [employees] are laid off [they] must repay the loan all at once, or it will be seen as a taxable distribution.”

There were three main reasons participants reported taking out a 401(k) loan, according to the study. The first was to make ends meet (25%), the second was to pay off credit card debt (23%) and the third was to cover out of pocket medical expenses (22%). Employers are in a unique position to offer specific benefits that can help employees address each issue — avoiding 401(k) loans and keeping their retirement savings working for the future.

“The survey data and interviews with participants clearly show that 401(k) borrowers are under a great deal of financial stress,” says Brian Perlman, senior vice president and financial service practice lead for Greenwald & Associates. “One woman I interviewed took out a loan from her 401(k) to help her pay out-of-pocket medical costs related to her fibromyalgia. She was later forced to go on disability and defaulted on her loan. She — and all other participants — needs a better safety net.”

Employees say they would feel more comfortable with a 401(k) loan if employers offered a safety net. Automated loan insurance repays a borrower’s outstanding loan balance if the employee is laid-off, becomes disabled or dies, preventing loan default. The average defaulting borrower loses out on $300,000 of retirement security when taxes, penalties, potential cash-outs and lost earnings are considered, according to data from Deloitte.

Loan insurance could offer one solution, the study finds. A vast majority of participants find automated, low-cost loan insurance appealing and more than half believe their employer should add it. Furthermore, 67% of participants say they’d consider contributing more to the plan if their employer were to add loan insurance.

Although these methods can help ease the burden of paying back a 401(k) loan, financial experts still generally advise against taking out a loan against a retirement plan.

“Most financial advisers are pretty stern about staying away from 401(k) loans,” says Jeffrey Edwards, a certified financial planner and president of Atlas Financial Planning. “However, for the average worker sometimes the 401(k) is their biggest or only asset. So there's not many options other than their retirement account.”

Edwards has two rules for any employee thinking of borrowing from their 401(k). The first is to remember this is a short-term loan that needs to be paid back quickly. If an employee can't afford the repayment, they shouldn’t take it. Second, employees should be sure they have the job security to take out the loan.

“If [an employee] quits or loses their job, they have two months to repay it,” Edwards says. “If you don't have that security or confidence, don't take it.”

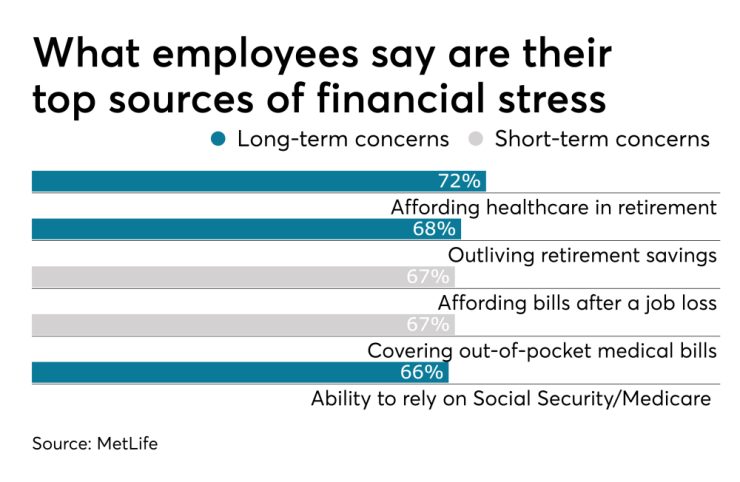

Financial concern is the number one stressor in employees’ lives, according to data from professional services firm PwC. When asked what causes the most stress, more employees cite financial matters (59%) than any other life stressor combined. Educating employees on how to best manage their finances, could help alleviate some of this stress.

“The best thing employers can do is offer financial education in the workplace,” says William Brancaccio, a certified financial planner with Retirement Wealth Partners. “This lack of education leads to financial stress and lost productivity. If employees were taught financial literacy they likely would understand the importance of an emergency fund, which may prevent 401(k) loans.”