Wouldn’t it be nice to pay for your employee benefits with the same ease as swiping your card for your afternoon Starbucks?

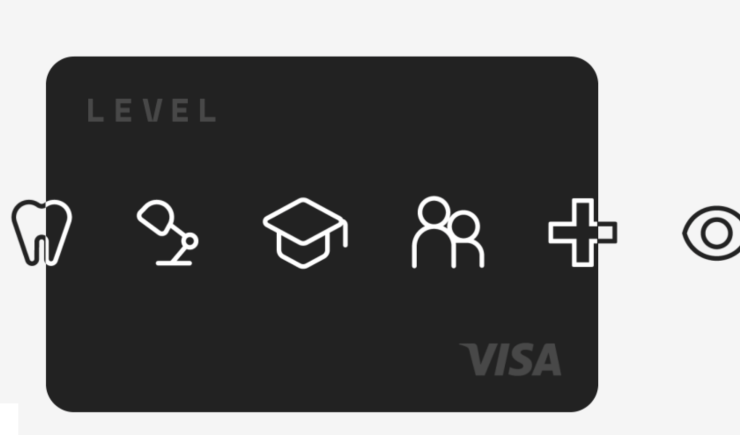

Level, a flexible benefits provider, recently launched Funds and the Level Card, a program that allows employers to load money onto a card to pay for benefits like childcare,

The program was implemented to help employees actually utilize the myriad of benefit programs available to them and give them a familiar way to engage with their employer’s offerings.

“We help give employers more flexibility to easily compensate their teams and offer a more streamlined approach to benefits,” says Paul Aaron, CEO and founder of Level. “There’s so much fragmentation in the benefits space and as a result, employees often feel that they don't have as much value in their benefits as employers are actually paying for.”

Read more:

The average employer spends $11.38 per hour per employee on employee benefits, according to the Bureau of Labor Statistics. However,

“The idea is to help employers give benefits to their employees that will be more meaningful to them both at work and in their day-to-day lives,” Aaron says. “This can be anything from food programs to fitness programs, home office stipends, pet costs. These categories have become much more relevant to people in the current work from home environment.”

Funds and the Level card act in the same way as a debit card: employers provide employees with monetary amounts per category and the funds are preloaded onto the Level card. When accessing services, employees pay using the card, without needing to be reimbursed later. Employers can then track usage and see which benefits are being used the most, in order to decide how to better allocate their benefits budgets.

Read more:

By taking the guesswork out of what’s covered and what’s not, employees can get the support they need to bring their best selves to work, Aaron says.

“We've been really focused on actually making benefits as easy to spend on as other consumer products. As consumers, we know how to use our payment cards to buy coffee or to buy dinner, wherever we want to go,” Aaron says. “We’ve taken the same approach to benefits: we’ve enabled people to spend and take care of their basic needs without having to become experts in insurance or their specific employee policies.”