When Blackbaud revamped its financial fitness program earlier this year, the software company expected high participation in the program.

But Cary Shealy, director of HR for Blackbaud, says when they started offering two-and-a-half-hour financial wellness classes in the middle of the work day, employees were initially skeptical.

“There is a little bit of a tentative nature of employees to commit,” he says.

It was a lot of time to take off work, and employees weren’t sure they needed it. But as it turns out, they did. Once a first round of workers completed training, word of mouth quickly spread the educational benefit of the offering.

“We get a good bit of traction from that,” he says.

Today, some 85% of employees who participated in Blackbaud’s program have taken a positive action to increase their financial wellness. These actions have included an increasing contributions to a 401(k) plan, adding to a 529 college savings plan, contributing to a savings account or setting up a meeting with an adviser to discuss financial goals.

“We’re seeing behavioral change from the employees that participate,” Shealy says.

See also:

Blackbaud offers its financial fitness program through Bank of America. The program includes four modules that focus on financial security, utilizing financial wellness benefits such as 401(k)s and HSAs, setting savings goals and transitioning to retirement. The program also includes the opportunity to meet one-on-one with a Merrill financial adviser.

“There is a tentative nature of younger employees to reach out to a financial adviser,” he says. “But by easing the barrier to access, by removing it, it truly does set those individuals up for success.”

Blackbaud’s Shealy says employee retention is another reason why the firm decided to invest in financial wellness benefits. But they also feel strongly about supporting employees long-term financial goals.

“We feel somewhat of an obligation to make sure we’re doing everything we can for our employees to make sure they are successful as possible,” he says. “In turn we find they develop a sense of loyalty to our organization.”

Blackbaud’s move mirrors a broader trend of more employers investing in financial wellness benefits. In the recently released annual Workplace Benefits Report, Bank of America found that more than twice as many companies are offering workplace financial wellness programs today (53%) compared with four years ago (24%). Kevin Crain, head of workplace solutions for Bank of America’s retirement business, says employers are starting to realize the value of financial wellness and develop education programs to help improve workers’ financial health.

“If you look at the retirement services industry and the financial services industry, it’s not only the concept, but they’re tying into it what they call more actionable financial wellness,” he says.

See also:

But there is still more work to be done, Crain adds. Employees can still use more education on finances, even though the majority (55%) feel financially well, Bank of America finds.

Employers should be looking at the entire financial life journey of an employee, Crain says. Workers are often the most stressed about whatever financial issue is occuring in their daily lives. For example, employees may not be as keen contributing to their 401(k) if they are struggling with student debt, Crain adds. So employers have a responsibility to acknowledge that issue and find a way to mitigate it.

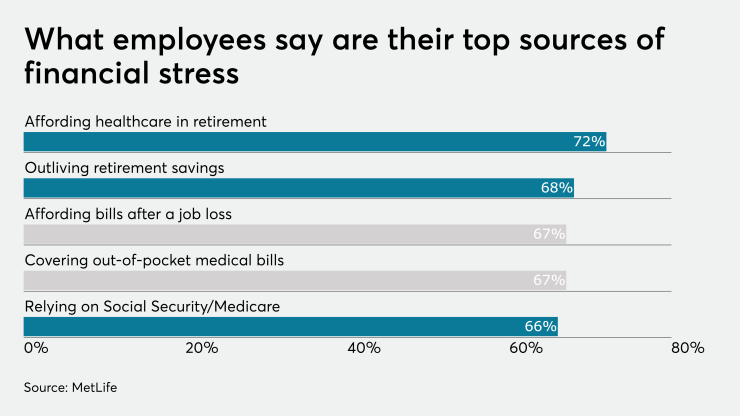

“Employees may be the most stressed by the most immediate thing going on in their life today. Do they have enough emergency savings? Do they have credit card debt?” Crain says. “How do they address those immediate financial security needs?”