Cash balance plans that move away from traditional interest crediting rates based on a long-term index, such as a 30-year Treasury bond, to a crediting rate based on real market returns have the best and most stable funded statuses among cash balance plans, according to research by consulting firm October Three.

Larry Sher, a partner and actuary at October Three, says that “the account-based design facilitates the flexibility to adapt to the changing needs of new generations of employees and their employers. A current example of this adaptability is the trend toward providing interest based on market returns of a plan’s or other specified assets.”

More than 90% of plans that use a market interest crediting rate are fully funded.

The big idea behind using real market returns is to decrease the volatility in

Unlike a traditional defined benefit plan, cash balance plans place more of the volatility on the shoulders of the account holders, similar to

“Their accounts now can go up or down, just like their 401(k)s,” he says. “But in the long run, if they leave the money, if the money stays in the plan, if it is a long-term venture for the employees — which it should be because this money is supposed to be for retirement — they should be able to earn more by having full market returns instead of the fixed income type of returns they would get under normal circumstances.”

Cash balance plans are becoming more prevalent in the U.S. Of the roughly 45,000 single-employer defined benefit plans in the country, more than 15,000 have cash balance features, according to October Three, and the vast majority of these plans have fewer than 100 participants.

October Three’s research focused on cash balance plans at companies with at least 100 participants. It found that these types of defined benefit plans are gaining in popularity in the manufacturing, health care, finance/insurance, professional services like legal and medical, and utilities industries.

The industry as a whole has been a rollercoaster, he says.

“The big question is: Are corporations going to jump into this space or are they inclined to go with the herd? The rest of the herd is into this freeze and immunize liability-driven investments,” Sher says. “The trend is clearly toward getting out of defined benefit plans.”

Cash balance plans can offer companies a way to continue maintaining a defined benefit plan with more of the perks normally associated with defined contribution plans. Employers and employees share the investment risks, and employers can provide annuities directly from the cash balance plan. That’s unlike defined contribution plans, which have to get insurance companies involved to provide annuities to their participants.

Cash balance plans offer professional asset management but fewer investment choices than defined contribution plans, experts say.

“That’s what a 401(k) plan is for,” Sher says. “They are meant to work together. If someone has a cash balance plan, they should also have a 401(k) plan so they work as two parts to a program.”

See also:

Both plans express an individual’s totals as an account balance. The difference is that the balances in the 401(k) are actual, and in a CB plan, they are notional accounts. Employees don’t own the asset like they do in a 401(k) plan.

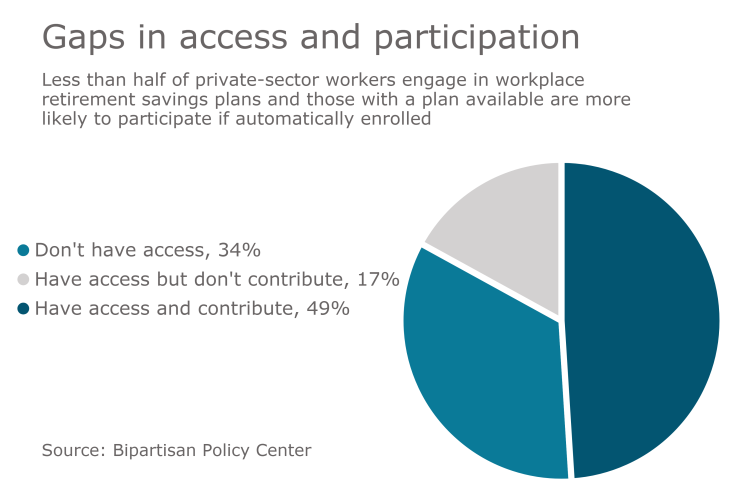

“A market return cash balance plan is another step toward a 401(k) but everybody participates. You don’t have to have auto enrollment,” he adds.

The Great Recession in 2008 caused many employers to freeze or close their defined benefit plans to new employees. Many plans are still frozen and there “is going to be a natural reluctance to unfreeze them. Companies may view that as taking a step backwards,” Sher says.

He points out that a high percentage of mid- to large-sized DB plans have been frozen — more than half — and that fewer cash balance plans have been frozen.

Sher believes that companies who have already frozen their plans or are considering freezing or terminating their plans when interest rates go up should consider converting them to cash balance plans with real market returns.