Finfit, a financial wellness counseling firm, is now offering free coaching to employees using its financial wellness platform.

Users of the fintech’s software will be able to connect with certified financial counselors, who can guide them through one-on-one budget coaching for specific debt issues, as well as mortgage, vehicle or student loan decisions. Pete Ostberg, the company’s chief operating officer, says managing finances can be overwhelming for workers, who may not know where to begin.

“That’s where our financial coaching benefit comes in — it’s like a personal trainer for your finances,” he says. “Having a financial coach in your corner will not only get you started down the right path, but also make sure you stay the course.”

See also:

Although there has been

Finfit’s platform is used by more than 125,000 employers including multi-national food corporation Pilgrim’s Pride and security company G4S. The service is offered as a free voluntary benefit but in some instances Finfit charges a monthly fee for each employee.

In March, the company rolled out an update to the education portion of its platform, Ready University. The tool has 38 lessons to train employees on topics including money basics, paying for college, loans and payments, buying a home and planning for retirement.

The new financial coach offering allows employees to reach out to a financial coach via phone or email during weekday business hours. Counselors receive certifications from the Association for Financial Counseling and Planning Education and the National Association of Credit Counselors.

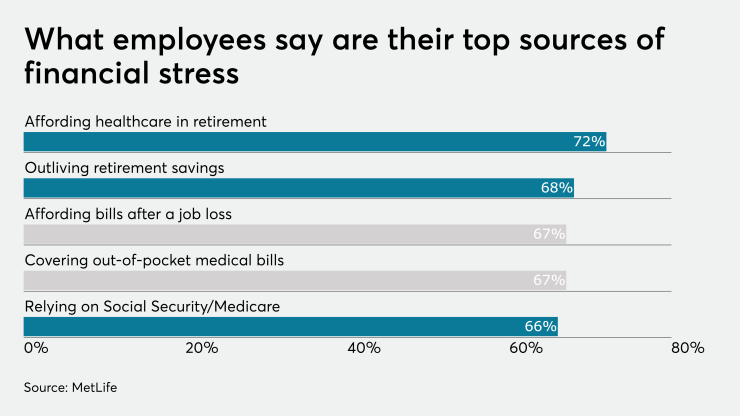

Ostberg says employers can play a greater role in helping workers become more financially sound. Indeed, financial matters are a source of great anxiety for workers. About 59% of employees say issues with money was one of their highest sources of stress, according to PwC’s most recent employee financial wellness survey. Additionally, more than half of millennials and baby boomers surveyed were concerned about not having enough emergency savings.

See also:

“I do think that employers can take a greater role in when it comes to creating awareness among their employees and ensuring they understand the benefits of their financial wellness program,” Ostberg says.

Employers also need to need to ensure they’re making financial wellness a topic of conversation in the office. Communications strategies such as newsletters, messages on employee portals, webinars and breakroom posters, are just a few of the ways benefit managers can ensure workers are aware of their financial wellness benefits.

“When the employer shows a true interest in the employees’ financial well-being and makes it part of their culture, it creates a positive environment that benefits everyone,” he says.