The financial services company is now allowing workers to earn performance rewards points to pay down their debt. The new program is offered in partnership with student loan benefit provider FutureFuel.io.

“Student debt is a societal problem and many people spend the better part of their life just trying to pay it off,” says Anthony Marino, executive vice president and head of human resources at First Data. “It’s also a business problem. In our time, most employers are going to have to think about this if they really want to attract and retain a quality workforce.”

To date, First Data associates have earned a total of $1.59 million in rewards points, which are earned based on performance. If all rewards points were directed to pay down student debt, it would translate into reducing $3.9 million of student debt, the company says.

Before implementing the benefit, First Data asked 6,000 of its associates to complete a brief survey about student debt, which revealed that 92% of respondents with student loans were interested in programs and benefits that would help them repay their student debt.

See also:

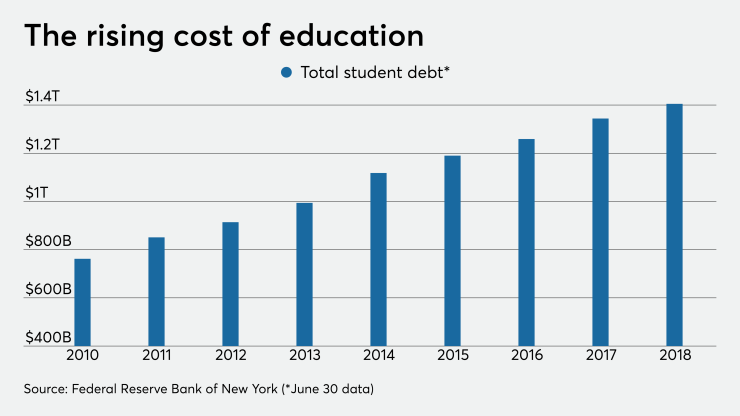

Nearly two-thirds of young adult job seekers have student loan debt — with an average balance of $33,332, according to data from the American Institute of CPAs.

When millennials were asked which benefits would help them achieve financial goals, student loan forgiveness was one of the top three most popular benefits together with health insurance and paid time off, according to recent research from the American Institute of CPAs. Experts say it shows the rising need for student debt assistance in the workplace.

First Data decided to incorporate the FutureFuel.io platform into its internal merit-based rewards program called Own It Honors. Through the program, First Data associates have the option to redeem their points as payments to their student loan of choice. FutureFuel.io’s platform aggregates multiple student loans onto the platform, presents the impact of the points to their student debt, and engages associates in games such as applying spare change from everyday transactions toward their highest interest rate student loan.

See also:

“Student debt is top of mind for many employees, especially for our millennials and young people entering the workforce,” says Laurel Taylor, founder and CEO of FutureFuel.io. “By 2025, millennials will make up 75% of our workforce, so this is something employers will have to address to meet the needs of these changing demographics.”

There is a small but growing group of employers that are offering student loan repayment to workers. The number of companies offering the benefit jumped four percentage points to 8% in 2019, according to data from the Society for Human Resource Management. Employers including

First Data’s Marino says the company is facing a tight labor market and they’re hoping the addition of these new benefits will be attractive to both current and future employees.

“In order to compete for today’s emerging workforce, and encourage associates to take a long-term view of their career path inside the firm, we understand the need to offer new and innovative benefits,” he says. “So far, we’ve had an overwhelmingly positive reaction from our associates in helping them pay down student debt.”