The changing demographic of small business owners is causing a seismic shift for insurance carriers. Millennial bosses are offering more benefits with a savings focus and their young workforce wants a greater emphasis on education, says Amy Friedrich, president of the U.S. Insurance Solutions business for Principal Financial Group, a financial investment management company based in Des Moines, Iowa.

Friedrich sat down with Employee Benefit News to discuss how the shift toward digital tools and education is forcing insurers to reconsider how they present their benefits options. This interview has been condensed and edited for clarity.

Employee Benefit News: Your research has shown that more than half of small business owners (58%) are optimistic about their companies’ financial health. Why is that?

Amy Friedrich: You could argue the causes and sources, but small business owners are feeling optimistic, which we think is pretty interesting in extending that to benefits. Because when they’re optimistic, we found there’s a direct link, actually, to purchasing and expansion and not just putting everything back toward wages.

EBN: That’s interesting, because reports say that employers fear rising healthcare costs and many small business owners can’t afford benefits.

Friedrich: Sometimes the loudest voices in the room are those baby boomer business owners. They tend to be the ones that have been in the business the longest. What you just characterized is very true and very aligned with the research we’ve done.

What you said gets less true as you start to cut it by Gen X and much less true as you look at millennial business owners. There’s a lot of focus on millennials as consumers but there’s not much focus on millennials owning and running businesses and the decisions they’re making. When you ask them, “Are you worried about healthcare costs?” or you give them a list of items to check the things that they’re worried about long term, healthcare doesn’t make their top three or top five.

EBN: What worries millennial business owners?

Friedrich: They’re worried about access to talent, technology, and cybersecurity. When you start to look into millennial business owners — which are growing proportionately in terms of the small business market, and they’re not just the super-entrepreneurs who employ one person and work out of their basement — we think their voice should be heard a little bit more. It’s a voice that’s not quite as concerned about what you’re going to pay for healthcare.

EBN: What kinds of benefits are they paying for?

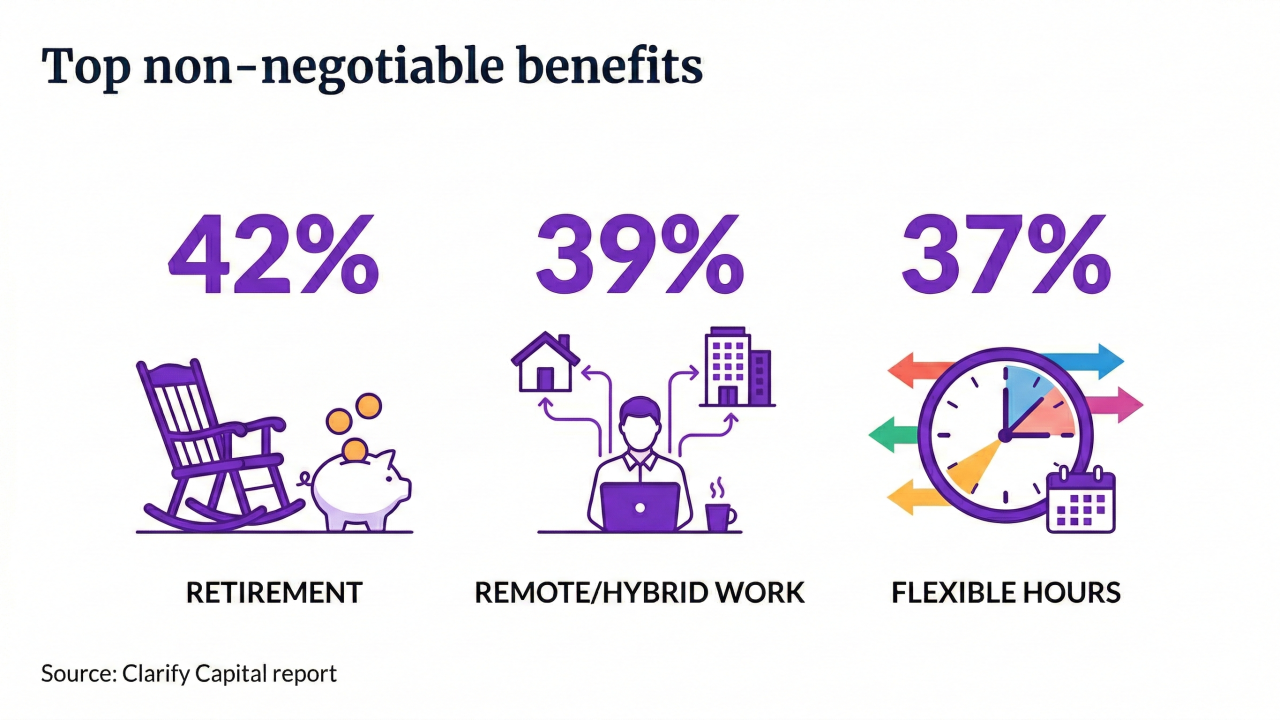

Friedrich: They are not yet wise purchasers of disability. They’re savers. What we see even more is that when you give them an option to offer a defined contribution plan, and some sort of 401(k), they will put that in place. When you ask them about things like life insurance for their employees, they’ll put a group life insurance plan in place.

Millennials are also pretty high users of financial planners. Financial planning is one of those areas that some people turn up their nose and say, “I don’t want to work with one.” But when you look at their usage for personal as well as business [needs], millennials are more apt to work with a financial planner than some of the other generations.

EBN: Why?

Friedrich: They know they can only do so much. They know they started a business based on being an expert. They in no shape or form assume they’re going to be a benefits expert or an HR expert. Maybe it’s [because of the] gig economy that they’re willing to let other people own the pieces that they’re experts at. They’re going to assume those services are out there, like “I can just go find it,” which also puts pressure on insurance companies, on the carriers, to actually offer some access that feels a little bit more digital.

We need to be very mindful that people want to use digital means to research. Let’s give them a great set of information. Our products aren’t always particularly understandable. Our products aren’t out there in a common language. We don’t necessarily use terms that always make sense, like secondary beneficiary designee. Why are we even talking about that at that point in the process instead of just talking about income more broadly? We start using tax terms for other sources of income.

EBN: How much data do millennial business owners need?

Friedrich: Eventually, to get the business process compliant with local and federal laws, we’ll need to get really specific about how millennials understand income and how we understand beneficiary designations. That puts pressure on us to have a really engaging set of research and education [resources] upfront that helps small business owners be able to actually say, if I’m in this part of the country and I employ this many people and maybe I’m in this industry, do other competitors offer dental insurance? Do they offer disability insurance? Do they offer a 401(k)?

Being able to benchmark and understand if I should be worried about dental insurance or offering vision insurance, those are the things that [successful carriers] are going to do to wind up reaping bigger benefits.