Company pension plans play an important role in a business’ success, which allows employers to provide for their employees’ futures. Setting up a competitive retirement planning strategy for your employees doesn’t stop with benefits for them, however. It also gives you an edge, in more ways than one.

People are your company’s strongest asset, and a good retirement plan increases your appeal as an employer. It’s instrumental in helping you attract and retain quality employees, lower your company’s tax burden and help you save for your own retirement, too.

Today, much of the workforce is dependent on an employer-sponsored retirement plan, such as a 401(k), instead of personal savings accounts and home equity investments. This makes retirement benefits a larger draw for potential and existing employees, but you also need to create and offer a competitive retirement plan.

From an employer’s point of view

A great pension plan helps you attract younger talent and baby boomers alike.

By offering retirement benefits, you display confidence in the growth and stability of your company, which is a key consideration for seasoned talent. Younger workers see the chance to build their nest egg by continuing to work in your company instead of switching jobs.

See also:

Let’s not forget the tax benefits, either. Making contributions to employees’ 401(k) plans could qualify your business for tax credits, while contributions and plan expenses are often tax-deductible. You can also use employee plans to save tax-deferred money for your own retirement, reducing your income tax bill today or in the future.

Business owners or self-employed individuals typically invest in a group retirement plan rather than an IRA. The company can match a portion of your own contribution to this plan, too. This helps both you and your employees get closer to your retirement goals.

From an employee’s point of view

Retirement planning is becoming a priority for workers of all age groups. Employees want to hang up their boots early and enjoy the golden years in comfort while they still have their health.

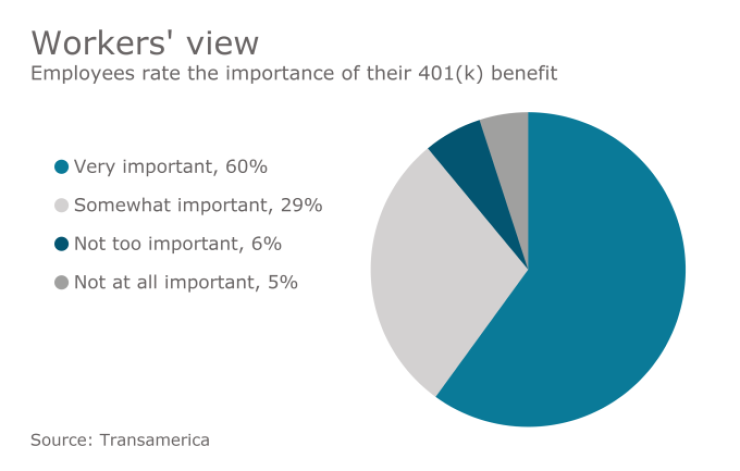

Unlike previous generations, most employees today depend on their IRA or 401(k) savings to help them meet expenses after retirement. In fact, a qualified retirement savings plan through work forms a large portion of the nest egg for many families, increasing the likelihood that primary bread earners will take these benefits seriously.

Common features of group 401(k) plans, such as automatic enrollment and matching contributions by employers, also make it easier for individuals to save more for retirement and meet their personal financial goals, both today and tomorrow.

See also:

Employers offering more than the bare minimum, as required by law, in benefits will generally find more favor with skilled workers. Competitive retirement plans can encourage loyalty and productivity because employees tend to care more about a company that cares about them.

Tips for designing an effective employee retirement plan

- Explore various 401(k), 403(b), IRA, profit-sharing, defined-benefit/pension plans to weigh their benefits against your unique needs.

- Invest in protected group retirement or pension plans safeguarded from company risk.

- Educate employees about different plans available through your company, as well as how they work.

- Help them understand the importance of proper retirement planning and the benefits it offers.

There are many company retirement plans, each with their own features, benefits, tax implications, complexity and costs. Remember, what works for one employer may not work for you, so take your time to find one that meets your business goals. f