A frequent question I get from 401(k) plan participants is “What type of contributions should I make, Bob: Roth 401(k) contributions or traditional pre-tax 401(k) contributions?” After reading the results of a study that was recently published in

First, let’s talk about how the two differ. Traditional pre-tax 401(k) contributions are made without deductions for state and federal taxes. Contributions and earnings grow tax-free until they are withdrawn. At distribution, contributions and earnings are taxed at the individual’s state and federal tax rates.

Roth 401(k) contributions are after-tax contributions. They also grow tax-free — along with the associated earnings — until withdrawn. Different from pre-tax 401(k) contributions, Roth 401(k) contributions and earnings are not taxed when withdrawn, provided they have been in the plan for at least five years and are paid out due to a

The old way of determining how to contribute

Until I reviewed the results of the study, my answer on how participants should contribute would have been to make both traditional pre-tax 401(k) contributions and Roth 401(k) contributions. Here’s how I came to that conclusion.

If you believe that tax rates will be higher in the future (and most tax experts do), it would be best to have your contributions taxed now at a lower rate rather than in the future at a higher rate when your balances are distributed. This line of thinking favors making all Roth 401(k) contributions.

However, the future is uncertain.

Although we are close to historically low tax rates at both the state and federal levels, there is no guarantee that tax rates will be higher in the future (even though the odds seem to favor it). As a result, it appeared to make sense for 401(k) plan participants to make both Roth 401(k) and traditional pre-tax 401(k) contributions in whatever percentages they felt most comfortable—e.g., 5% Roth + 5% traditional 401(k) or 7% Roth + 3% traditional 401(k).

This strategy seemed to ensure that whatever happened with tax rates in the future, participants would benefit with at least a portion of their total 401(k) account balance.

Results of new Harvard study

The

The key study finding was that participants contributed the same percentage amount whether they made Roth 401(k) contributions or traditional pre-tax 401(k) contributions. This is important because in the case of Roth 401(k) contributions, taxes have already been paid. An example may help.

Assume one participant makes 10% traditional pre-tax contributions and another makes 10% Roth 401(k) contributions for their entire careers. Also assume that they invest in the same funds and have the same earnings experience. Let’s say they both end up with $1 million at retirement. The Roth 401(k) plan participant truly has $1 million, however, the traditional 401(k) plan participant has $1 million minus state and federal taxes. A huge difference.

The study points out that a way for traditional pre-tax 401(k) participants to make up the difference would be for them to save some of the tax savings each year into an account that would be used to pay taxes when balances are distributed. But no one does that. That is just not how we think.

The Roth promise

Given these study results, it will still be difficult for many participants to make exclusively Roth 401(k) contributions because they don’t believe the government will maintain the 100% tax-free withdrawal provision associated with Roth 401(k) balances. In other words, they don’t expect our elected officials to keep their

I believe that if there is a change in the tax code regarding Roth 401(k) account withdrawals, it is likely that grandfathering provisions will be attached. So building a Roth 401(k) account balance is probably worth the risk.

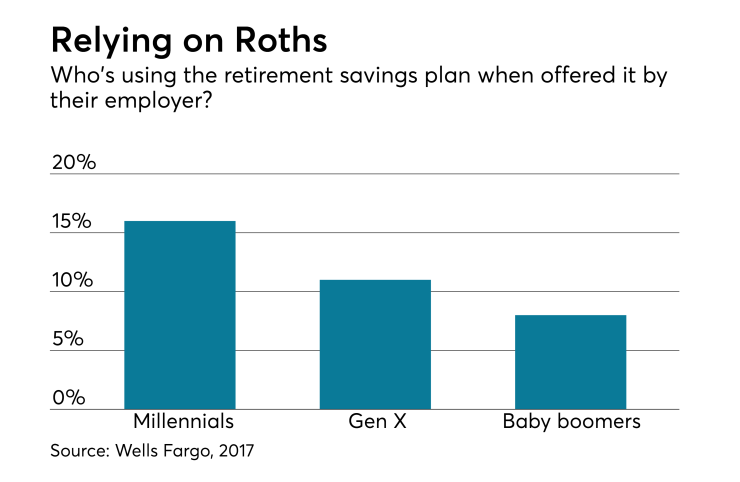

If you don’t currently offer Roth 401(k) accounts in your 401(k) plan, you should consider adding them, and in-plan

Robert C. Lawton, AIF, CRPS is the founder and President of