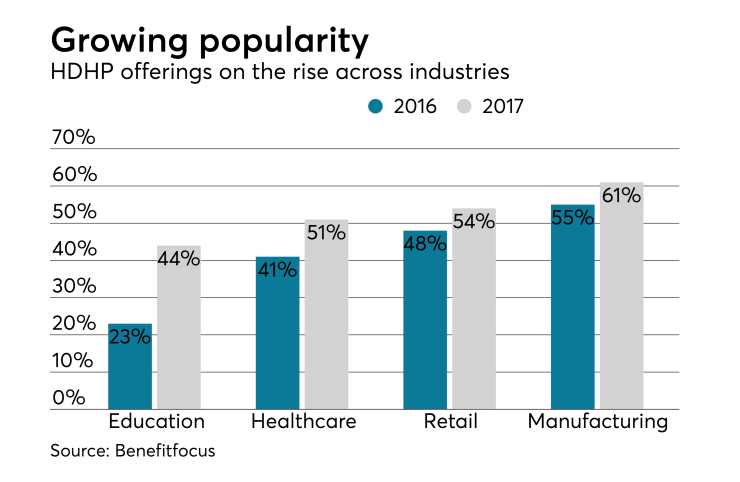

Most employers have dipped their toes in the high-deductible health plan waters, either because they’ve implemented a plan or because they’ve considered it as part of their benefit offerings; 29% of covered workers are enrolled in HDHPs with savings options up from 4% in 2006, according to the Kaiser Family Foundation.

The goals of implementing this type of plan are twofold. First, these plans usually provide a much-needed premium savings. Second, HDHPs are designed to encourage consumerism and motivate employees to make more cost-conscious choices — for example, using urgent care over the emergency room when appropriate.

Unfortunately, high-deductible health plans may also have some unintended consequences — for instance, think about the employee who is struggling financially and perhaps even living paycheck to paycheck. Facing the reality of plunking down $100-$200 or more for a sick visit at the primary care doctor’s office or urgent care facility may preclude them from seeking care. That’s why employers must ensure they best communicate to employees the advantages of such plans.

So, how can employers help employees manage the financial equation of HDHPs that are clearly here to stay? Here are some tips.

Help them prepare for expenses. One suggestion is to propose they prepare a budget for anticipated medical expenses — such as quarterly sick visits to primary care physicians and the cost of maintenance medication. Providing a worksheet to estimate annual out-of-pocket expenses can be helpful, perhaps with common examples included.

Some employers partially fund the deductible with a contribution to a health savings account. When possible, the employee should consider allocating a portion of their pay toward the remaining deductible amount. This will ease the worry of not having funds to cover the deductible, and any unused funds rollover.

HBy contributing to an HSA, the employee gets an immediate tax savings and builds up a fund to use as needed. In the event there is a medical expense that exceeds the balance in the account, encourage employees to request a payment plan equal to their HSA contribution. When the contribution goes in, they can then make the payment. Most medical providers are open to these types of arrangements. Consider a communications campaign to explain the functions of an HSA.

Encourage employees to become educated consumers. Employees are generally not thinking about their benefits everyday and need to be reminded of the value of becoming an educated consumer when they do use their benefits. Direct employees to carrier cost estimator tools for everything from MRIs to prescription drug costs. Many carrier websites provide instructional videos to demonstrate how these features work. Send the links out on a proactive basis or consider offering a healthy lunch-and-learn to discuss these resources.

Encourage lower-cost options. With any health plan there are a number of ways to save money. Encourage employees to use lower-cost options such as:

· Generic drugs over brand-name when possible

· Mail-order prescriptions for management drugs

· In-network/preferred providers versus out-of-network

· Telemedicine, if available

Take the opportunity to remind employees about these lower-cost options frequently.

Leverage employee advocacy. Even with the best efforts to educate employees, it may be difficult for them to absorb all the information. Direct employees to an employee advocacy team if it’s available. These experienced healthcare benefits professionals can assist with research and provide meaningful suggestions to help employees get the most out of their plan for the least cost.

Managing medical costs will likely remain a challenge for both employers and employees so it is important to stay informed as new cost transparency tools become available and to constantly educate employees so they can make informed choices that are also affordable for them.