Commentary: Wellness is a concept many of us are familiar with. It is often a primary topic for speakers at human resources conferences, written about in the media, and discussed between employers and employees.

However, wellness conversations are often one-dimensional. While employers define the topic in different ways, most are focused solely on the physical. Its useful to zoom out and define wellness in a much broader way to include not only an employees physical health, but also their mental/emotional and financial well-being. After all, these three dimensions of wellness are clearly intertwined, particularly in the minds of employees.

Medical plans typically provide coverage to address physical and mental wellness (along with employee assistance program benefits). These plans use incentives to help promote engagement, while premium differentials drive the desired behaviors. Both affect finances. Each of these dimensions is a key consideration in developing a successful wellness program. Moving in this direction can be challenging. Employers need to assess where they stand now and how they can get to a place in which all three dimensions of wellness are being addressed.

For employees to embrace each dimension, employers must deliver creative communication through a variety of methods over a period of time. This approach is essential for success; employee participation begins with helping them to develop a deeper understanding of whats in it for them. Part of the long term strategy may include engaging spouses and dependents to participate in the program as well.

Also see:

And probably the most impactful way to get your employees attention is to talk about their wallet.

Financial wellness

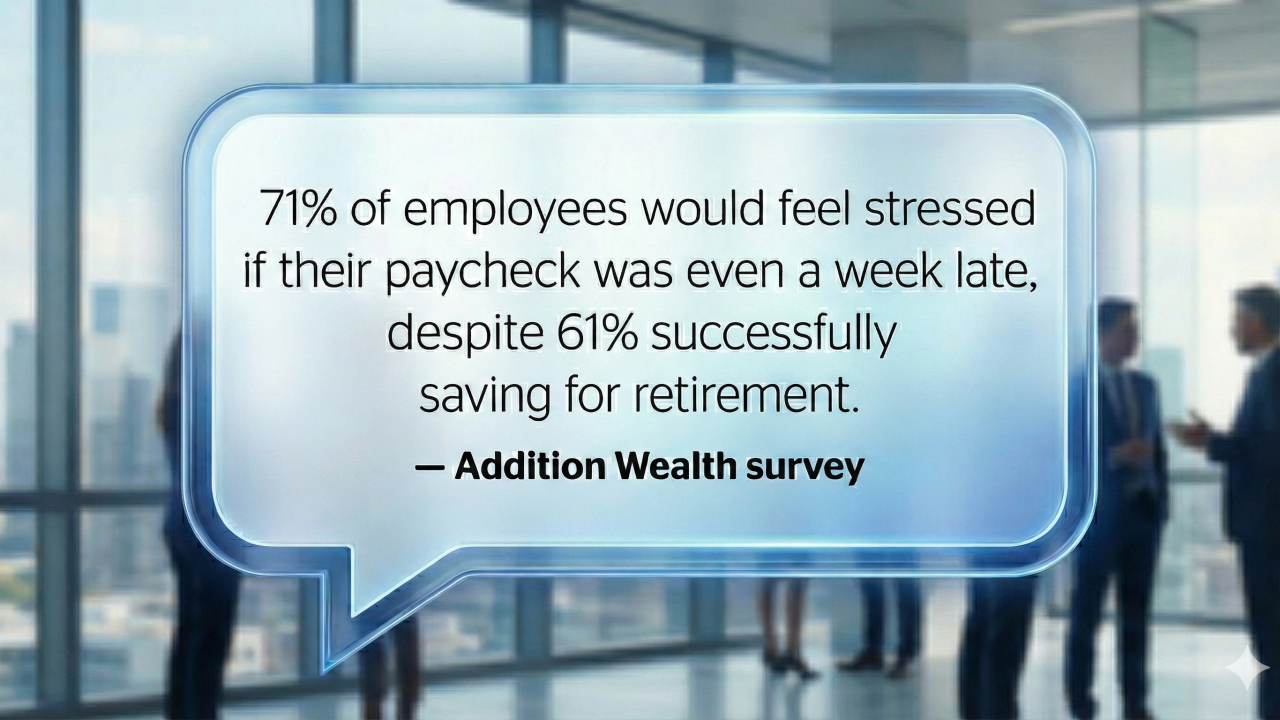

While the old saying your health is your wealth is in many ways true, finances have a huge effect on the employees physical and mental well-being. Specifically, financial problems often lead to physical and emotional issues. Consequently, employers need to be mindful of their employees financial wellness.

So whats the best way to provide support with financial matters? It makes sense to lean on established partners who are experts. Consider taking advantage of educational seminars available through existing credit union or banking relationships. Popular topics may include managing your credit, buying a home or preparing a budget.

Wise employers will also help employees plan for the future. For instance, employers offering 401(k) retirement programs are smart to educate employees about how to fully maximize utilization in order to save and invest money while deferring taxes. Directing employees to online resources and calculators can be an important way to facilitate this education. More assertive organizations may even consider auto enrollment in 401(k) plans to get people started on the savings path.

Also see:

Finally, employers offering high deductible health plans paired with a health savings account option should adjust the messaging based on the demographics of their workforce. For example, the primary appeal to younger workers might be the opportunity for premium savings and the opportunity to use nontraditional medical care like acupuncture or chiropractors. Older workers might view this account as another way to shelter taxes and save for medical expenses or even long-term care in retirement. Regardless of what types of plans are offered, employees need help figuring out what will work best for them. Providing the necessary guidance to help the employee navigating this landscape will maximize the opportunity for tax savings, and to potentially save on premiums. This puts more money in the employees pocket and typically creates a greater bond with the employer.

Dont sweep mental health under the rug

Employers want their employees to be fully engaged ready, willing and enthusiastically able to do their best work. For that to happen, employees need to be in the right frame of mind. The topic of emotional health can range from simple day-in, day-out distractions to far more significant mental health issues, such as depression or substance abuse.

While society has gotten more accustomed to discussing these issues in a mature manner, it can still make for uncomfortable conversations in the workplace. Forward-thinking employers are learning to become more attuned to the mental health needs of employees.

Also see:

Most employers have employee assistance programs, although these programs are often underutilized. Plan design becomes important to ensure that proper resources are available. There is also the issue of advocacy to help employees find assistance when it is needed.

An in-shape workforce

And of course there is the physical dimension of wellness, which is what most wellness programs focus on. The driving force is typically the desire to control costs but, more and more, a wellness program is seen as an employee privilege.

Its important that an employer designs a wellness program that fits its employee population and culture; just because the CEO is a marathoner doesnt mean the only incentives offered should be for completing 5Ks.

Also see:

Weve come a long way with wellness over the past couple of decades. The concept has matured from the days when we only spoke about disease management.

But there is still a long way to go. As the race to attract talent intensifies and cost pressures continue to exist, embracing a three-dimensional model for wellness is one that can become a significant business advantage.

Loretta Metzger, benefits consultant for the Corporate Synergies Washington, D.C., regional office, is an accomplished health care professional with a strong background in HRIS technology, benefits administration and Affordable Care Act compliance.