A desirable benefits package can look very different to members of the five generations that make up today’s workforce. Brokers partners can help employers determine and define what a competitive benefits plan looks like, not only for their current employees, but for those they are hoping to attract.

Because people are working longer than ever, the employment landscape contains five different generations of workers: traditionalists, baby boomers, Generation X, millennials and Generation Z. Understanding the differences between each of these generations can help employers select the best benefits plan for the entire workforce.

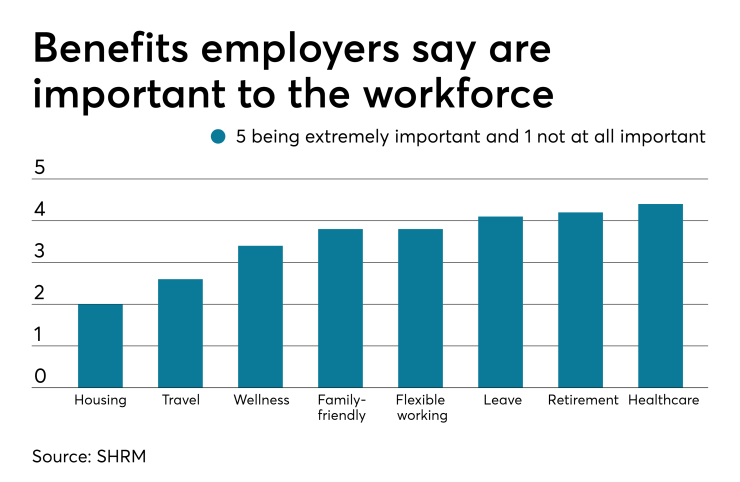

In general, today’s workforce values comprehensive healthcare coverage most, followed by affordability and choice of providers, according to data from the Society for Human Resource Management. In fact, according to a recent study by SHRM, more than half (56%) of U.S. adults participating in employer-sponsored health benefits cited satisfaction with their health coverage as a key factor when deciding to stay at their current job. Employer can offer employees the ability to save money on their healthcare expenses through flexible spending accounts, health savings accounts and other tax-advantaged financial tools. Flexible work hours, retirement planning, paid time off, paid parental leave and benefits related to professional development and education, are also important.

But on a more micro level, each generation also has a different set of values and priorities. Baby Boomers value salary level, health insurance and a retirement plan above all else. Gen Xers combine the desire for salary levels and 401(k) plans with the need for job security, career advancement opportunities and work-life balance. Millennials and Gen Z, who grew up in a world of rapid change, seek paid time off, the ability to work remotely, control over their schedules and a high level of flexibility.

Even the need for health insurance varies by generation, according to a recent MetLife report. A full 90% of baby boomers between the ages of 51 and 64 make healthcare their top priority. Once they reach age 65 and become eligible for Medicare, the percentage declines. Millennials consider health insurance less desirable than other generations, but 70% still want the option to sign up for it.

Millennials also tend to choose the lowest-cost options, with nearly half opting for high-deductible health plans. Workers over age 50 tend to use tax-advantaged tools such as HSAs and FSAs more than their younger colleagues. Baby boomers also place a higher priority on dental and vision insurance than younger generations, while wanting the flexibility to drop maternity services and prenatal care from their health insurance package.

Consider taking these steps before and after plan selection.

Use employee surveys. Ask employees for feedback on a variety of benefits topics from healthcare to retirement, paid leave and wellness programs. Solicit information about what they would like to have that isn’t available and what benefits could be dropped from the plan.

Track plan usage. Which plan features are most widely used? Which have the smallest enrollments? Trim costs by dropping little used features that come with high price points. For employee populations that skew towards younger generations, expand a sense of choice and flexibility by offering lower priced features, even if anticipated enrollment is not particularly high.

Promote healthcare and benefits literacy. Helping employees learn more about their personal health, including how to address healthcare costs and get the right treatments, can help both participants and employers. With benefits, people need to know exactly what they’re getting in order to take full advantage of and feel greater satisfaction with their plan. Whether in print or digital format, resources written in simple language without complicated jargon can make a huge impact on plan success.

Providing a flexible, competitive benefits plan that aligns with real-life needs sends current and prospective employees a powerful message. It shows them that their employer cares about their quality of life as well as their contribution to the company, and makes for a more engaged and loyal workforce.