Since mid-March, we've been focusing on financial education, hosting virtual workshops for our client's employees. The workshops help employees reflect on their current financial situation and identify areas for growth.

At first, we didn't know what to expect. We floated a variety of presentation topics to employees. Did they want to know how the CARES act related to them? What to do with their stimulus checks? Or, did they want to learn more about the basics of personal financial management?

Read more:

According to a recent Charles Schwab Financial Literacy Survey conducted by The Harris Poll, Americans wished they had better money management skills. When asked what they would teach their younger selves about personal finance based on what they know today, Americans said the value of saving money (59%), basic money management (52%), and how to set financial goals and work toward them (51%). This data supports our approach to our polished workshop curriculum.

After almost six months of virtual workshops, we're certain employees want to know more about money management basics. We've doubled down on them, providing a 90-minute financial wellness workshop that touches on emergency funds, credit, student loans, debt, and retirement. We've seen that increased financial education at work can help your employees understand how the rest of your benefits package supports their financial goals.

Retirement has emerged as a favorite workshop section among employees. For example, our simple, visual approach to explaining compound interest is popular among attendees. Recently, a client saw a 9% increase in 401(k) contributions following our workshop. Their employees are taking action to improve their long-term financial future and ease their

According to recent data analyzed by

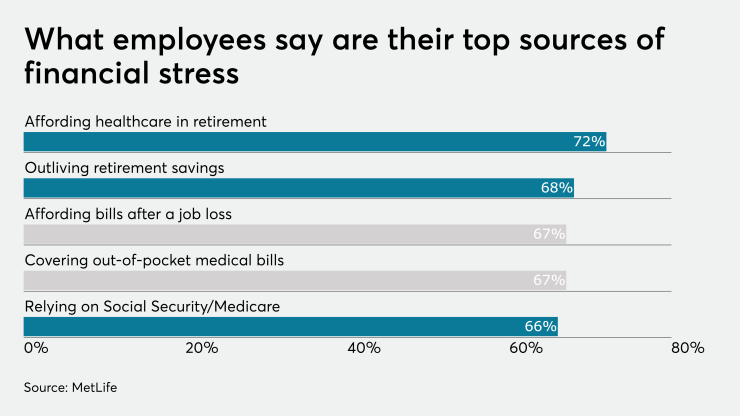

You probably have a robust benefits package in place that can help your employees significantly reduce their financial stress. But it may not be obvious to your employees exactly how participating in your 401(k) plan, or securing life or disability insurance, can ease their long-term financial stress. A financial wellness program can help them connect the dots between their financial goals and the rest of your benefits package.

At HoneyBee, we help employees get clarity around their financial goals and provide accountability and support with on-demand financial experts, education, and no cost rainy day funds. Employees walk away from financial wellness workshops with newfound knowledge, a clear direction, and a robust support system. Help your employees get clarity around their finances and tap into the benefits they already have with a financial wellness program. And, use the program to combat financial stress with accountability and support that's personalized.