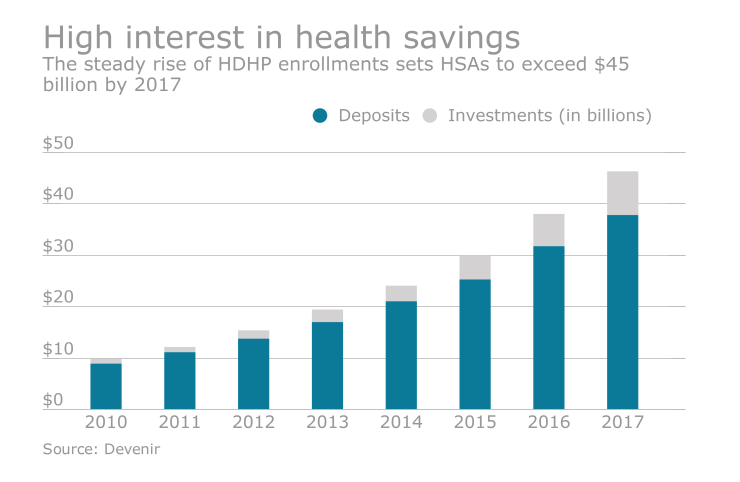

Health Savings Accounts are skyrocketing in popularity as premium increases have become the new normal. Recent reports project that employees will open 30 million of these accounts with assets

HSAs are also popular because they offer triple tax savings: HSA contributions can either be made pre-tax or deducted at year-end; any interest income or earnings on investments tied to an HSA remain tax free, and as long as the HSA funds are used to pay for qualified health care expenses, then no taxes will be charged on distributions.

Additional HSA benefits include:

· 100% of unused funds roll over year-after-year.

· Funds are transferable and go with the employee to a new employer, in the event of a job change.

· Funds can be used to pay for the eligible expenses incurred by an employee’s spouse or other tax dependents regardless of their insurance status.

· Funds can be used for Medicare premiums as well as qualified long-term care premiums.

“Hidden” HSA benefits

Another, often-overlooked benefit is the use of an HSA as an investment tool. HSAs provide more benefits than traditional Investment Retirement Accounts and the funds can be invested into a wide array of bank accounts, stocks, bonds, money market funds and mutual funds. Rather than using the HSA solely to pay for medical expenses, participants can retain these dollars as investments and the account balance grows tax-free. For this reason, many HSA participants elect to pay smaller medical expenses out-of-pocket, with after-tax dollars, preserving their HAS balances for future growth.

Let’s say an HSA participant is in the 25% tax bracket and contributes the family maximum (currently $6,850) for 30 years, on which he or she receives a 4% annual return. The employee would have nearly $400,000 at the end of this period and could use the money to his healthcare costs in retirement. Beginning at age 65, any distributions from the account would be tax-free, if used for qualified medical expenses. If the funds are used for non-qualified expenses, the distribution is taxable but still exempt from the 20% penalty.

In contrast, if a participant used her HSA assets to pay for out-of-pocket healthcare expenses, while contributing any savings to a taxable investment account, her assets would compound at a much slower rate and would be subject to all applicable taxes.

Not every HSA participant understands all the advantages that this savings tool has to offer. In fact,