So you’ve taken the plunge into self-funding. The first few months can be overwhelming, given the abundance of data at your fingertips. But that data can be powerful.

You probably found with traditional, fully-funded insurance, there is limited customization available when structuring the components of your plans, and you’re forced to bundle your plan to include the carrier’s offering for reinsurance, pharmacy coverage, managed care and wellness programs, among others. With newfound freedom from your carrier’s insurance bundles, there’s no better time to review your health and welfare insurance offerings and carve out the portions that would be better managed by third-party vendors.

Choosing your carve-outs

The benefits of carve-outs are in their ability to offer better options for managing cost and benefits offered by experienced vendors. Those third-party vendors can customize their programs to meet the specific needs of your benefit programs.

For example, choosing a stop-loss carve-out for organ transplant or high-dollar specialty prescription drugs will protect your organization from catastrophic losses in those categories by assuming the risk of some procedures and offering services to enable better coordinate benefits and provider selection.

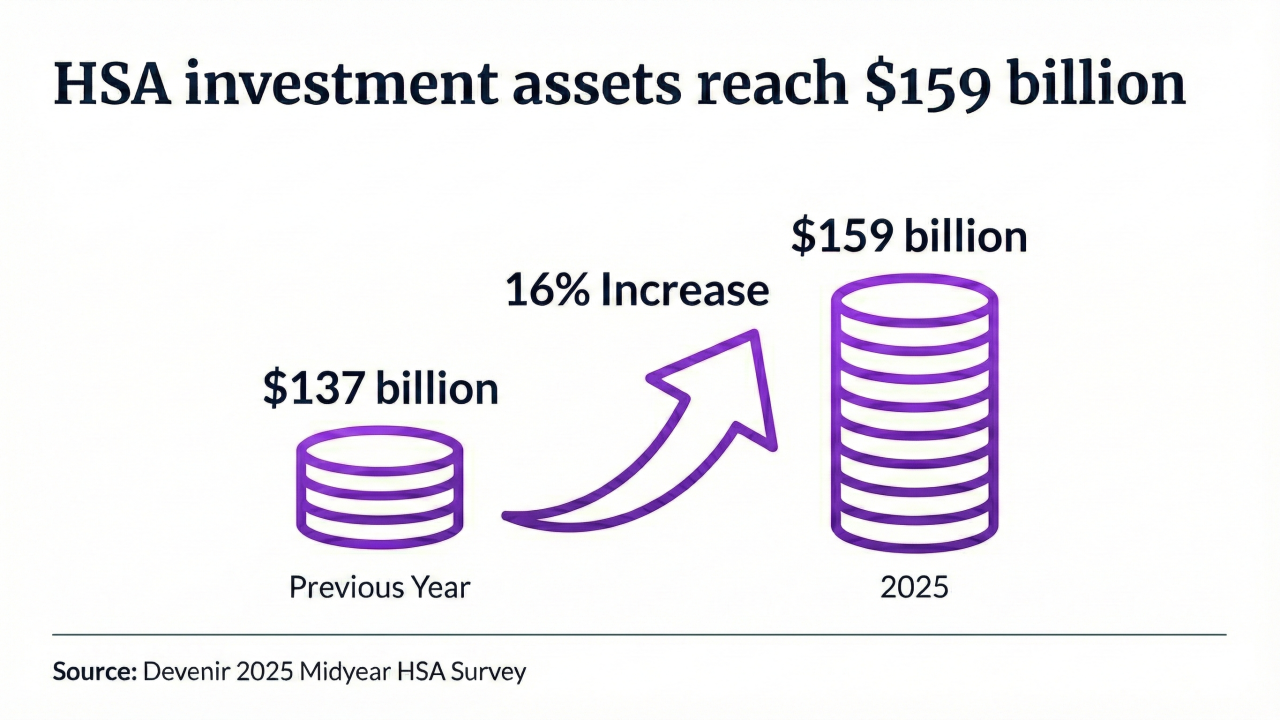

Carving out benefit structures can also streamline complex offerings and provide continuity while changing other components of the plan. Examples of benefit structure carve-outs include mental health services, health savings accounts and wellness services.

Advantages and disadvantages

For self-funded employers seeking to understand cost drivers, carve-outs are a great choice because they offer a full spectrum of data points including utilization rates, most common claims and the number of employee inquiries. The competition between vendors and a variety of service options also provides opportunities to save on rates.

Plus, the transparency of a carve-out enables more precise budgeting and the ability to predict renewal rate increases or to appeal rate increases that aren’t paired with changes in the clearly defined service.

However, insurance carve-outs can be difficult to manage due to the number of potential vendors involved. Certain vendors or carriers may not be integrated; therefore, administration becomes more complex with each added carve-out. These plans also require more employee education, as participants will interact with different vendors for different services.

As is true with any type of health plan, employees who aren’t informed consumers can generate unnecessary costs in mismanaged care and improperly filed claims.

When to start carving

With carve-outs, size matters. Large, self-funded employers will have a better selection of vendors because their large population can be leveraged to negotiate more palatable rates and customized structures.

Larger employers are also more capable of maintaining an HR team with enough internal resources to manage multiple insurance vendors. Not all third-party vendors will integrate perfectly with other vendors; managing multiple relationships while also keeping an eye on the different risk thresholds can be complicated for an HR staff. For mid-sized employers, an experienced insurance broker can fill the role of internal resources where they are in short supply.

HR will also be responsible for ensuring participants are properly educated about plan offerings. This means educating them at enrollment and throughout the plan year, and leveraging multiple communications channels to make sure the information is received. With more than one vendor or carrier managing services, confusion can cause employees to choose out-of-network providers or file a claim with the wrong insurer. A formal employee education and communications campaign can prevent these issues.

Monitoring program utilization, claims and administrative costs to measure the success of carve-outs will help you know if unbundling is working, and how well.

In all, the keys to making the most of this transition are to know your data inside out and to lean on the experience of your broker. With so many new opportunities for customization and cost-control, they will be sure to steer you toward the strongest result.