Blue Cross Blue Shield of Massachusetts is offering a new student loan benefit to its 3,800 employees. The health insurance company is paying $75 monthly towards individual workers student loan debt in addition to providing one-on-one financial coaching and guidance on repayment strategies.

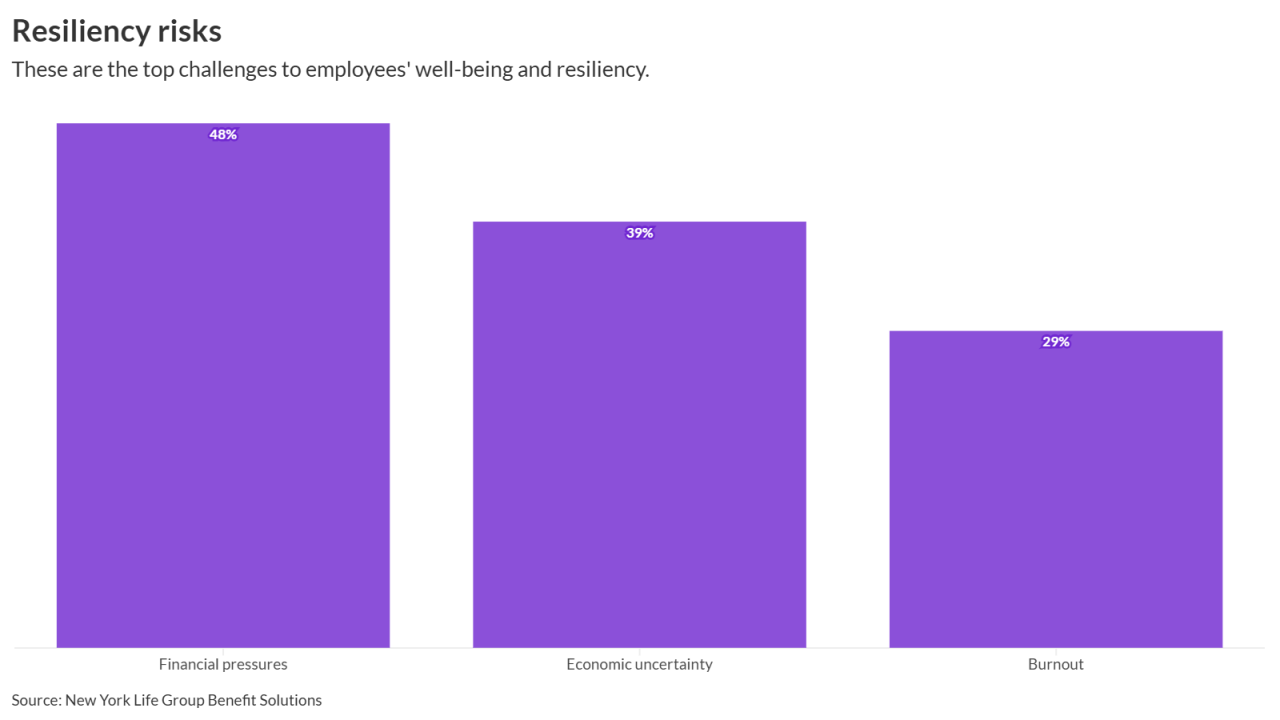

“We do surveys every year to take a pulse of how our employees are feeling about different things as it relates to benefits,” says Lesley Delaney, director of benefits at Blue Cross Blue Shield of Massachusetts. “One of the things we noticed was that financial well-being was a big stressor for our associates.”

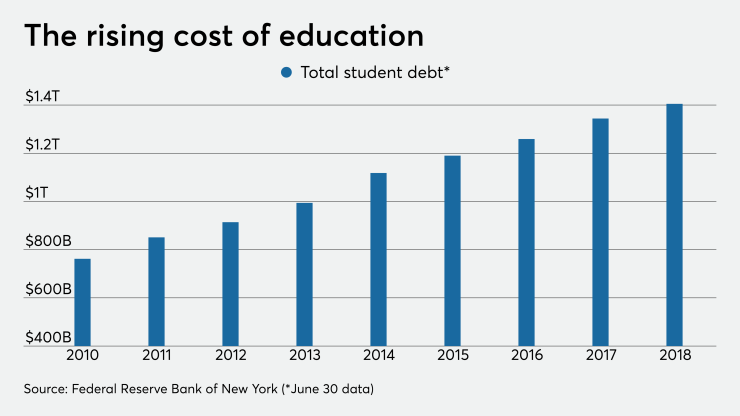

The amount of student loan debt in the U.S. has ballooned to more than $1.5 trillion, according to the Federal Reserve. Yet only 8% of U.S. employers offer employees a student loan repayment benefit — although this number is up from 4% in 2018, according to the Society for Human Resource Management. Employers are in a unique position to offer benefits that will help alleviate this financial burden, experts say.

Some companies have become more aware of the impact of student loan debt. For example, employers including

Blue Cross Blue Shield’s student loan repayment program is administered by Bright Horizons EdAssist Solutions. Employees can use the program to create a customized loan repayment plan with a suite of debt management solutions.

“The benefit is great because it’s not just to repay loans, there are some qualifications that employees need to satisfy,” Delaney says. “You can’t be in default.”

If an employee’s loans go into default, the benefit offers educational and consulting services to help them get out so they can use the repayment benefit.

“It really touches everyone in every kind of financial situation,” Delaney says.

Employers are taking more of an interest in their employees overall well-being as they introduce initiatives to help alleviate stress and promote greater financial wellness. In addition to the student loan benefits, Blue Cross Blue Shield also expanded its tuition reimbursement program to $10,000 per year. The benefit used to be 80% reimbursement, up to a maximum of $5,000 for undergraduate and $10,000 for graduate courses. Blue Cross Blue Shield also lowered the cost of medical coverage for employees under a certain salary threshold.

“Student debt is one of the main concerns for [younger employees]. It’s no longer saving for retirement. It’s ‘how do I make ends meet now?’,” Delaney says. “It’s definitely a great tool for retention and attracting talent.”