Trilogy Health Services, is expanding its student loan repayment benefit through a partnership with Tuition.io.

Employees at the senior care provider — nurses, therapists and administrative staff — will be among the first to utilize Tuition.io’s newly expanded suite of education assistance benefits. The new benefits include student loan repayment assistance, scholarships for employees and their family members, and access to Tuition.io's financial wellness platform and mobile app.

“Tuition.io helps us get visibility on how much student loan debt our 1,200 employees have. It was a little over $36 million,” says Todd Schmiedeler, senior vice president of foundation and workforce development at Trilogy Health.

Trilogy Health has offered its employees a student loan repayment benefit for about four years. The company initially managed the benefit internally, but it quickly became an administrative burden.. Last year, Trilogy decided to outsource the benefit and partnered with Tuition.io. Since switching to the new provider, Trilogy has doubled the number of participants in its program.

“The reason they chose us is we have a broader perspective on the services we need to offer in the education assistance market,” says Scott Thompson, CEO of Tuition.io.

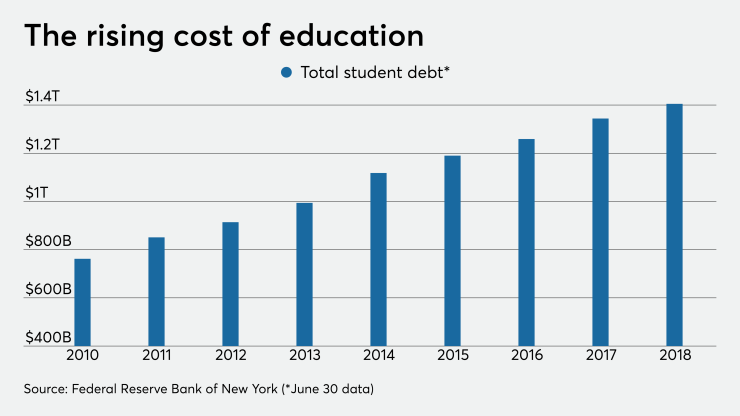

Student loan repayment programs are some of the most in demand employee benefits. Indeed, it is the number one new benefit employers are beginning to provide, according to a study by ADP. The number of employers offering student loan repayment benefits rose to 8% in 2019 from just 4% in 2018, according to data from the Society for Human Resource Management. Some employers offering the benefit include

About 70% of nursing school students graduate with student loans, according to data from the American Association of Colleges of Nursing. Each Trilogy Health employee owes an average of $31,668, the company says. Eligible employees receive monthly contributions of $100 to help pay down their principal loan balance and there is no lifetime maximum. The program is now available to full-time and part-time employees who have been working for at least six months.

“The biggest reason to offer a student loan repayment benefit is it’s the right thing to do for your employees,” Schmiedeler says. “I ran the retention numbers for our board. In today’s labor market it is extremely difficult to recruit highly talented people. So the best thing [employers] can do is grow and keep your best people.”