- Key Insight: Learn how benefits are shifting from perks to financial-security and inclusion-focused supports.

- What's at Stake: Failing to modernize benefits risks retention, morale, and competitive employer branding.

- Supporting Data: 58% offer automatic retirement enrollment; 38% provide automatic contribution increases.

- Source: Bullets generated by AI with editorial review

This is part two in a two-part series on the current state of employee well-being.

According to EBN's 2025 Workplace Well-being Survey, benefit leaders are

Nearly nine in ten (88%) say supporting employee health and well-being is the top objective of their benefits strategy, followed by boosting satisfaction and morale (55%) and retaining existing talent (53%). Far fewer cite improving workplace culture (33%), attracting new talent (32%) or enhancing productivity (18%) as key goals.

The findings suggest that benefit leaders are focused first on ensuring employees feel supported and engaged before leveraging benefits as broader tools for culture, performance or reputation building.

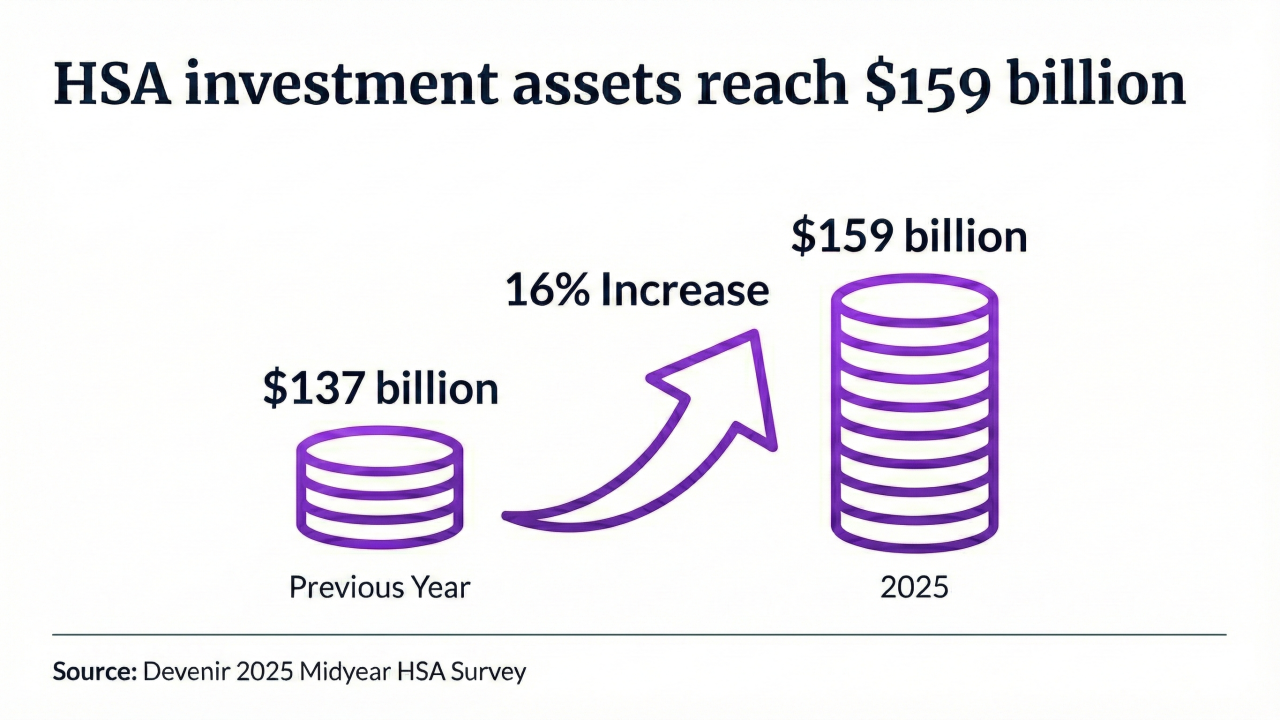

Expanding financial wellness offerings

EBN's 2025 Workplace Well-being Survey shows that benefit leaders are expanding wellness through financial security and inclusion-focused supports rather than purely lifestyle perks. More than half of respondents (58%) now offer automatic enrollment in retirement plans, and 38% provide automatic contribution increases, signaling a growing emphasis on long-term financial resilience as part of employee well-being.

Read more:

These automated features can significantly boost participation in retirement savings — improving employees' financial confidence while strengthening retention, loyalty and trust in the employer's commitment to their future.

Yet, innovation beyond traditional benefits remains limited. Fewer employers have adopted female life-stage support,

Benefit support for life stages still lacking

By making financial wellness automatic, broadening support for underrepresented needs, and offering choice-driven benefits that promote flexibility, organizations can strengthen morale, engagement, and retention — while reinforcing that employee well-being is both a moral and business imperative. Incorporating these offerings not only enhances the employee experience but also drives measurable business outcomes — from higher retention and satisfaction to a stronger employer brand in an increasingly competitive labor market.

Read more:

Finding the right vendors remains a challenge

EBN's 2025 Workplace Well-being Survey highlights an ongoing balancing act for benefit leaders: While nearly half (48%) say they prefer to work with fewer vendors, most admit consolidation isn't a top priority, and one-third (33%) don't mind managing multiple partners. Only 17% work hard to minimize vendor relationships, and just 3% intentionally work with many vendors.

This split underscores a key challenge — and opportunity — for benefit leaders striving to meet employees' diverse well-being needs. With new solutions emerging for mental health, financial wellness, and life-stage support, leaders must find ways to streamline administration without sacrificing innovation.

The right vendor partnerships can help bridge that gap, offering integrated platforms, shared data insights, and cohesive employee experiences. As well-being strategies grow more complex, benefit leaders who collaborate with adaptable, cross-functional vendors will be best positioned to deliver personalized, high-impact programs while maintaining operational efficiency.