When employees are living with a serious health condition such as cancer or a chronic condition such as heart disease, COPD or back pain, the cost for their care can add up quickly, leaving many with large bills for medical care and prescription medications.

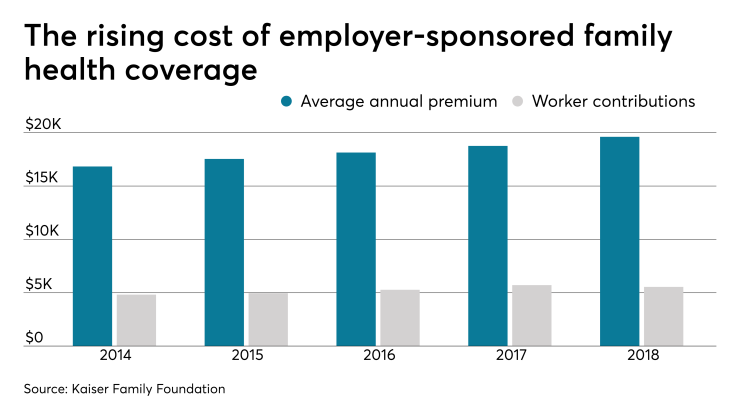

The Kaiser Family Foundation recently

To help employees manage the risk of high medical bills and debt, employers can deploy several strategies focused on educating employees on how to get the most out of their insurance benefits and providing support services and voluntary benefits that help them pay for care and ensure that the medical bills they receive are accurate.

Helping employees understand their health insurance benefits

The first step in helping employees to better manage their healthcare costs is to make sure they have a strong understanding of how their health insurance plan works. While most employees understand that they will pay less for care when they chose in-network providers, many don’t realize that simply because their primary care physician or specialist is in-network, that doesn’t necessarily mean that other providers they’re referred to, including diagnostic testing labs, imaging facilities, hospitals and rehabilitation centers, will be in-network as well.

Ongoing employee education through email, company intranet, newsletters, and lunch and learn type events can help reinforce the need for employees to ensure all providers are in-network before they seek care. The company’s health plan providers or health insurance broker may also offer services to help employees verify that all providers they’re referred to are in-network.

Benefits and services that lower the risk of high unexpected medical bills

There are a number of ways employers can help mitigate the impact of the cost of care for employees who face high medical costs.

· Help employees pay for care with FSA and HSA accounts: Offering healthcare spending accounts, with or without employer contributions to the accounts, gives employees a way to budget for and fund care costs including deductibles, out-of-network care and high cost medications. These funds can be especially helpful if an employee chooses to go out of network to gain access to a specialist who has special expertise treating the serious condition he or she faces.

· Provide access to second opinion services: To ensure employees are not only getting the most accurate diagnosis but also the most appropriate treatment plan for their condition, employers can offer access to second medical opinion services for employees who face a serious, rare or complex diagnosis. Second opinions can be sought in person or virtually. A growing number of medical centers of excellence offer virtual or remote second opinion programs. There are also institution-independent vendors that offer these services.

· Offer specialty pharmacy services: When employees are prescribed high-cost medications, such as cancer immunotherapies and biologics or medications to treat hepatitis C, nerve pain and HIV, specialty pharmacy services can provide advice and guidance to employees to ensure that the medications prescribed are the most appropriate ones and that employees are receiving medications that need to be administered by infusion or injection in the most appropriate and cost-effective setting — for example, at a physician’s office rather than a hospital outpatient clinic, where the cost can be five times higher.

· Lower the risk of inappropriate care and duplicate testing: Offering employees who face a serious or complex health problem access to advisory services can lower the risk of inappropriate care, which not only has an impact on the employee’s health but also on the cost of care. An adviser can provide employees with evidence-based information on treatment options as well as gathering and reviewing all medical records to lower the risk of unnecessary or duplicative care, lab tests and imaging.

· Connect employees with a billing advocate: According to some estimates, between 30% and 80% of medical bills in the U.S. contain at least one error, and in nearly a third of those cases, the error represents a significant amount of money. A billing advocate can not only review bills for accuracy and dispute incorrect charges with hospitals and providers, an advocate can also help negotiate a cost reduction when employees face surprise high medical bills, for example in cases when they were unaware that an ER physician, anesthesiologist or radiologist was not in their health insurance network.

Armed with these resources and tools, employees will be better prepared to both decrease the risk of higher than necessary medical bills and deal with unexpected medical costs if they incur them.