Dream Forward 401(k) is putting a new spin on the term robo-adviser.

The small 401(k) provider, based in New York, N.Y., has developed an artificial intelligence interface to help 401(k) clients deal with the emotional issues of saving for retirement.

Dream Forward is not a robo-adviser in the traditional sense, says Grant Easterbrook, co-founder and CEO of Dream Forward, because it does not use artificial intelligence to come up with the best possible asset allocations for participants. Instead it uses AI to address participants when they decide to take negative steps regarding their 401(k) plan participation.

Also read:

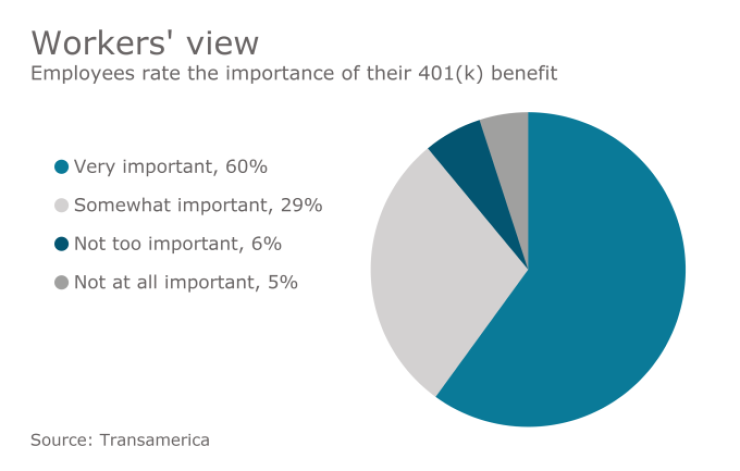

One of the biggest challenges in the U.S. is that even if people have a retirement plan through work, they don’t invest in it. Dream Forward developed an artificial intelligence system that comes up with good arguments for why participants should take certain steps.

Employees are auto-enrolled into the 401(k) plan. If they try to opt out, they have to go through the Dream Forward website. If they take a negative action, like reducing the amount they are saving for retirement, the AI system will kick in and ask them why they are doing that, how it can help and what’s on their mind.

Employees use many excuses for why they don’t save for retirement, Easterbrook says. Putting their kids through college is a big one, or not making enough money. The system is programmed to react to all of the top reasons people cite for not doing what they should be doing when it comes to retirement savings, Easterbook says.

“We are dealing with the challenge that people are not saving enough money in the first place. They’ve got some excuse for putting it off,” he says. “So how do you design an experience around that to maximize what people are saving for retirement and not putting it off. This is different than financial calculators or allocation tools. It is a different focus.”

In the case of a client not saving enough because they have to put their kids through college, Dream Forward’s system is programmed to tell them that students can always get student loans to attend college but nobody will give them a loan in retirement.

“Retirement is a much higher priority than college is,” he says. “That’s the type of emotional advice we give. … They use every possible excuse. This gets them to stop and think and not take that course of action.”

Dream Forward just signed a partnership with Barnum Financial Group, which is part of the Mass Mutual family, to offer its clients access to the company’s 300 financial advisers.

Rather than using artificial intelligence to replace that human component, Dream Forward believes the two should work together. The artificial intelligence can determine what plan participants are doing wrong and what their fears and worries are and that information can then be used by Barnum’s financial advisers to come up with educational topics that would have the most impact on a specific plan’s employees.

“We do believe that the ultimate future of technology is human financial advisers working with AI,” he says. “Human advisers aren’t going anywhere. AI is supporting them and making them more efficient by holding the hand of users on the spot.”

In many 401(k) plans, the financial adviser goes in blind. They host a generic meeting with employees about the retirement plan and nobody shows up, he says. By using artificial intelligence to determine what employees are concerned about, the plan’s financial advisers can devise much more targeted outreach.