I’ve been thinking about retirement — specifically my own — a lot lately. Maybe it’s because my birthday is coming up this month (according to new research from LIMRA, birthdays are the top reason that Americans begin planning for their retirement).

Maybe it’s because I’m already daydreaming about fewer deadlines, reduced stress and more traveling (who says you can’t retire in your 30s?). Or maybe it’s just because I’m tired of reading sad stories about retirement and feeling like just another statistic.

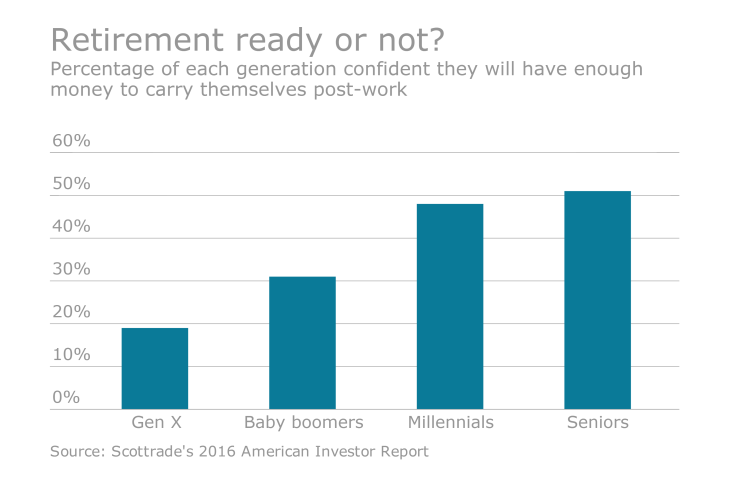

Every headline about the subject screams that employees aren’t remotely ready for retirement. And new research from Betterment for Business drives that point home. Not only did the 401(k) service provider find that employees are not confident about when they can retire, more than half of employees aren’t certain that they will retire comfortably when they want to. The research also found that workers aren’t sure how their 401(k) plans operate. And most were in the dark, too, about 401(k) fees, educational efforts, how their employers fit into all of it — the list goes on, Betterment found.

All of this led me to sit down with an adviser to see where I stood in regard to my own retirement.

My finances were a bit disorganized — stagnant retirement accounts from two previous full-time positions made me the perfect example of the portability problem. It was the first time I really took a good hard look at my figures, accounts and goals.

When my retirement adviser asked me what I envisioned for my end-of-career goals, it occurred to me that no one had ever asked me that question. Nor has anyone asked me at what age I want to retire. Maybe those should be the new go-to questions for children, along with “What do you want to be when you grow up?” (My updated answer to that inquiry, by the way, would be a happy retiree…).

In preparing for retirement, getting your figures is a good start. But it’s amazing that most of us haven’t crunched any numbers — a widespread problem, my adviser told me.

An important finding from the Betterment study is that employers are likewise unsure about how prepared their staff members are for retirement.

“401(k)s are an amazing benefit that employers offer and can be a great tool to help employees save for retirement,” Cynthia Loh, general manager of Betterment for Business told me. “However, without easily accessible advice for employees on how to invest their portfolio, how much to invest and which accounts to save in, it seems that they may not be.”

Sure, we can debate how much accountability employees should have over their own retirement, but are we trusting them with too much power over their financial future? Knowledge is power, but financial education efforts are falling short. Financial wellness is too often a buzzword in many workplaces, rather than a practice. Annual information sessions and mailed statements only go so far.

And it’s time for that to change.

Digital tools, Loh (and my retirement adviser) points out, will help. But the main thing I want to know is: Plan sponsors, are you doing enough to empower and ready employees for retirement? Or are they going at this alone?