Equity compensation plans have emerged as an excellent way for companies and their employees to participate in one another’s success. For employers, these plans are a tool to attract and retain strong talent. For the millions of employees who have access, they are a means to build one’s own prosperity while contributing to that of the company.

In a recent

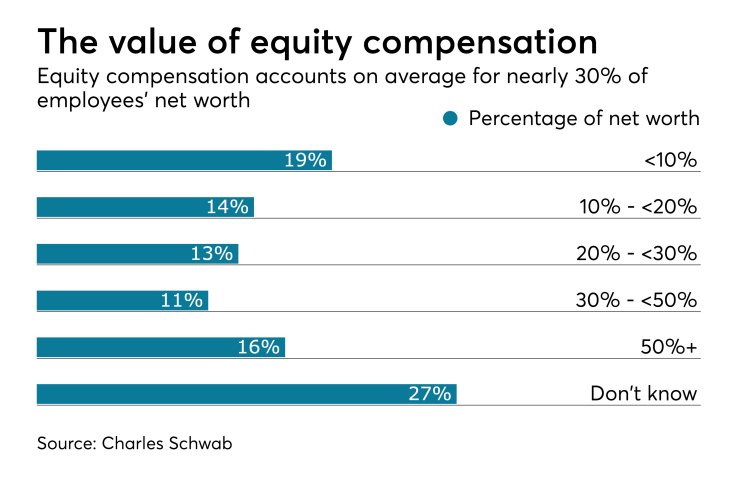

But employees may be depending on this benefit a little too much. The survey also found that, on average, equity compensation accounts for almost 30% of respondents’ net worth. The figures are even higher for millennials (42%) than for Gen Xers (24%) and baby boomers (19%). The majority of these folks (73%) also hold company stock outside their equity compensation plans, including in their 401(k)s.

The investment community has long understood the importance of a diversified portfolio. At Schwab, we typically recommend that an individual should have no more than 10-20% of his or her investment portfolio in company stock. Of course, that number can vary depending on someone’s situation, but it’s clear that a lot of equity compensation plan participants, and especially the youngest among them, are over-weighted in this category.

So what can employers do to guide their workers in a more diversified direction? Effective strategies include offering tailored education and

A well-rounded approach

Financial wellness programs encourage people to think more holistically. That is, they can help workers view equity compensation as one piece of a wealth-building puzzle, alongside retirement accounts, securities in a brokerage account, real estate and more. Looking through this lens, individuals can see how large a role company stock is playing in their overall financial picture and make sure it is aligned with their plan.

By encouraging this more holistic way of thinking, a financial wellness program can be especially helpful to younger workers who haven’t had time to accrue many assets outside of their equity compensation. Many millennials are preoccupied with present-day financial matters — like saving for a car or home, or trying to pay down

Why it matters for employers

Employees have often shown inertia when it comes to signing up for benefits that will ultimately help them in the long run, so employers might be tempted to wonder if implementing a financial wellness program is worthwhile. If the aforementioned survey respondents are any indication, the answer is yes. The majority of them reported that they would indeed use such a program if it were offered at work.

Some of the top ways in which employees think a financial wellness program would be helpful include balancing equity compensation with other investments and developing a financial plan — which speak directly to the issue of diversification.

Moreover, participants say that equity compensation allows them to participate in the growth of the company and even helps to alleviate financial stress. Less stressed, more engaged workers are more productive workers — making equity compensation plans supported by financial wellness programs a true win-win.