The war for talent is raging on as fiercely as

But the time is ripe for companies to invest in programs that are more tailored to

“Our research has found that 52% of working Americans are either looking for a job or considering looking for a job in the next few months,” says Trent Burner, vice president of research for the Society for Human Resource Management. “What’s important to

Read More:

When it comes to designing an improved financial

No two employee groups have been

Thirty-five percent of working women say their financial health has suffered due to

Read More:

“Regardless of employment status, women were more likely than their male counterparts to indicate that

Generationally, only 15% of baby boomers say they saw a financial uptick during the pandemic, according to the study, and only 28%of millennials said the same. Almost all of the generations surveyed indicated that personalized financial advice is something they consider to be important, especially Gen-Z, where 65% report craving this kind of education.

Among different ethnic groups, 63% of Black workers, 61% of Hispanic or Latinx workers, and 65% of employees who identify as other races and ethnicities are more likely to indicate that the personalization of financial coaching is important to them as compared to 48% of white employees.

Read More:

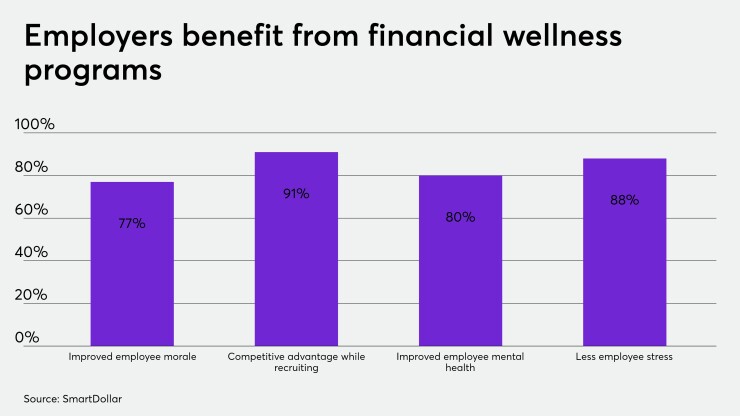

Holistically, the workforce is craving an expansion of financial well-being benefits, particularly perks that offer a one-on-one approach or consultation. For employers struggling to hire talent in a competitive market, access to financial advisers, student loan support and caregiving cost coverage can help make a compelling argument to job seekers.

“In our survey we found that 35% of organizations offer financial planning, and that compares to the 89% who offer other benefits like life and disability insurance,” Burner says. “Now is a good time to revisit the financial well-being offerings you're giving your employees and determine if they are utilizing them in the way they should and are you as the employer offering what they need, since their needs have changed.”