Providing a student loan benefit not only helps employees with financial security, it could potentially save their relationships with loved ones. Employers who don’t offer some form of relief could see talented employees walk out the door.

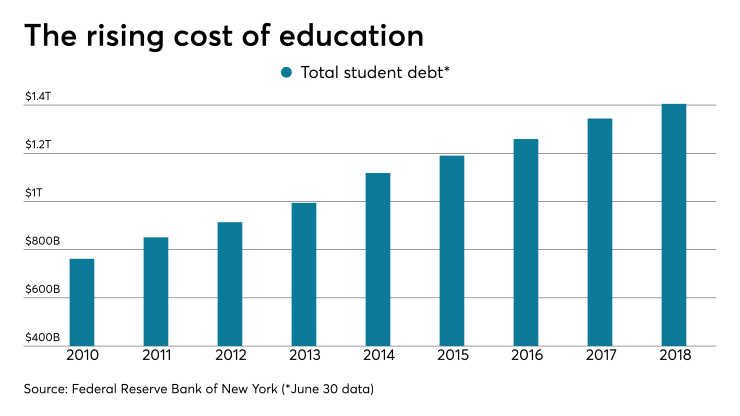

More than 44 million Americans have taken out student loans for themselves or a family member; collectively, they owe about $1.5 trillion. The majority (84%) of borrowers said student loan debt has negatively impacted their retirement savings, according to a year-long study by TIAA and the MIT AgeLab, and it’s causing friction within families. Nearly a quarter of borrowers say student loan debt is creating conflict with family and romantic partners.

“We have always known that longevity can be optimized by having access to retirement security and support from family,” says Joseph Coughlin, director of the MIT AgeLab. “What we now know is that for borrowers across the age spectrum, student loan debt can create shocks to both.”

Why should employers care? Financial and emotional stress are the leading causes of

Employers are starting to address the problem by ramping up student loan repayment benefits, which have doubled over the last year, according to the Society for Human Resource Management. During a panel at a recent

“Now we’re finding that part of making sure employees are healthy is making sure they are healthy as a whole person,” she said. “[There is a] unique opportunity in voluntary benefits to be more strategic about our offerings.”

While repayment benefits are certainly a sought-after benefit, TIAA representatives believe employers can best tackle the student debt crisis by focusing their efforts on financial literacy and retirement programs.

Much of the conflict and resentment that student loans bring to families is the result of poor communication, the TIAA study says. Over half of student loan borrowers “knew little” or “nothing” about the terms of the loans they took out for themselves, according to the study. A third of family members who took out loans for a child or grandchild were just as ignorant.

To squash the problem before it starts, TIAA executives recommend providing employees with access to financial advisers, who can explain in detail what borrowers can expect by taking on student loans. These meetings can also facilitate open discussions between family members so everyone taking on debt knows what’s expected.

“We believe that advice and coaching are key to navigating what can seem like competing demands,” says Roger Ferguson Jr., president and CEO of TIAA. “TIAA has found that people who engage with qualified financial professionals are better equipped to make decisions about paying for education for themselves or a loved one without sacrificing their future financial security.”

While the majority of student loan borrowers are saving for retirement — albeit not as much as they’d like — 19% aren’t contributing to a retirement account at all, according to the TIAA study. Employers are in the best position to help these employees stay on track for retirement, Ferguson says. He recommends offering retirement accounts providing guaranteed contributions with little or no match requirements. This design allows retirement savings to grow even if the employee is unable to contribute.

“To be sure, getting a college degree remains one of the smartest investments a person can make in their financial future — but saving for retirement is equally important,” Ferguson says. “Ensuring people fully understand their options and the impact of any loans they do take, along with innovative approaches to retirement plan design that enable employers to jumpstart people’s savings while they’re paying down their debt, can help address the issue.”